“Start where you are. Use what you have. Do what you can.”

–Arthur Ashe

Why Does This Brew Taste So Different?

We recently had 100s of advisors weigh in on what’s missing in their email inbox each week.

The basic takeaway: You want more market updates and industry trends delivered in a brief and succinct way that allows you to speak and act more intelligently as an advisor.

So we’re brewing up a new flavor this week ☕

You might like it….or you might hate it.

Either way, let us know if it’s something you like sippin’ on.

Give it a read and hit the thumbs up 👍 or thumbs down 👎 at the end of this email.

Alright, let’s brew this 💪

Best Thing I Read All Week

Dad Loses 80 Pounds to Become Kidney Donor For Sick Son

Hunter Kablutsiak, 16, was diagnosed with stage 5 kidney disease in 2020, which left his kidney operating at just 16%.

And while his dad, Daniel, was a blood type match, doctors said he had to be under 200 pounds to be a donor.

The only problem? He was hovering around 275 pounds.

But don’t underestimate a determined father. Daniel lost 80 pounds and the transplant is now scheduled for June.

“I’m really, really happy for my son,” he said. “I don’t care about myself, but as for my son, donating a kidney so he can be a regular teenager without having to take these 10 pills a day and stuff like that.”

More Women Making Bank…

But Still Doing the Heavy Lifting at Home

So, it turns out that even though women are bringing home more bacon than ever before, they’re still the ones frying it up in the pan 🥓

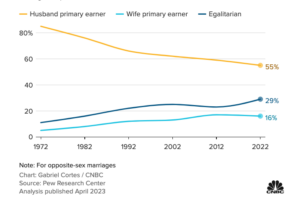

According to a new report, almost three times as many women are now the breadwinners in their households compared to 50 years ago.

But let’s not get too excited…

55% of men are still the big earners in their marriages. It’s like a classic game of Monopoly, except the fellas get to start with more money.

And if you thought the wage gap was bad, just wait until you hear about the “chore gap.”

Apparently, even when both partners earn about the same amount, women are still doing about 2 extra hours of caregiving and 2.5 more hours of housework every week.

C’mon, men. We can do better.

|

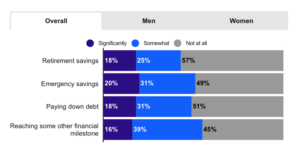

Financial Fact: On average, women save $3,146 annually compared to the $7,007 saved by men. This is partially due to something experts dub the “motherhood penalty.” With newborn children requiring around-the-clock care and few employers offering adequate parental leave, women often absorb more childcare-related expenses, which negatively impacts their ability to save |

Experts Say This is the Prescription for Money Stress

For millions of Americans, financial stress is like a migraine that won’t go away.

And it’s a self-feeding cycle of despair…

The more one of your clients worries about money, the more it makes them anxious about their financial future…and so on.

It’s kinda like how downing a big bowl of ice cream makes you feel bad, so you fix yourself another bowl to make yourself feel better.

(Not that I know anyone who’s ever done that.)

According to a FINRA study, a whopping 41% of adults in the U.S. are feeling the double-whammy of anxiety and stress when they think about their personal finances.

But researchers say basic literacy is the answer to calming these emotions and helping people feel more in control.

Specifically, people should be able to answer these 3 questions with no problems:

A. Suppose you had $100 in a savings account, and the interest rate was 2 percent per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

- More than $102

- Exactly $102

- Less than $102

B. Imagine that the interest rate on your savings account was 1 percent per year, and inflation was 2 percent per year. After 1 year, how much would you be able to buy with the money in this account?

- More than today

- Exactly the same

- Less than today

C. True or false. Buying a single company’s stock usually provides a safer return than a stock mutual fund.

Takeaway: If you want to help your clients escape the weight of money stress, it starts with equipping them with some basic financial concepts.

Takeaway: If you want to help your clients escape the weight of money stress, it starts with equipping them with some basic financial concepts.

Series I Bonds Set to Drop to 3.8% Amid Falling Inflation

It looks like the I bonds’ “golden era” is fading away, and it’s not just because grandpa fell asleep with his bonds again.

After peaking at a whopping 9.62%, the rates on Treasury I savings bonds are set to drop faster than a toddler on a slide. We’re talking about a slip from 6.89% to right around 3.8%.

Now, millions of Americans are left pondering the eternal question: CDs, HYSA, or Treasury Bills? It’s like trying to choose between your favorite movies – except in this case, there’s no popcorn and candy.

(Here’s a decent head-to-head comparison.)

|

Related: ▶️List of today’s top HYSA rates |

More Parents Sacrificing Finances to Help Adult Children Be Comfortable

A recent Bankrate survey shows that a whopping 68% of parents have sacrificed their finances to help out their adult children. Talk about a parent trap!

Interestingly, Baby Boomers and Gen Z are worlds apart when it comes to financial milestones.

Boomers think you should start paying your credit card bill at 19, but Gen Z is all like, “Nah, let’s wait until we can legally drink at 21.”

And don’t even get them started on housing expenses – Boomers say 21, Gen Z says 23.

As for auto insurance? Boomers say 19, but Gen Z is like, “Just chill! Can we enjoy our early-20s. We promise we’ll start at 22.”

The best advice for parents? Stand your ground.

“Remember that saying about putting your oxygen mask on before helping others,” says Ted Rossman, Senior Industry Analyst. “While we of course want to be empathetic and help our kids, sometimes financial assistance goes too far.”

Weekly ChatGPT Prompt 🤖

ChatGPT can be a handy tool to help create content to grow your practice. So here’s a prompt you can try to up your writing game.

Prompt: I’m a [your title] who helps [your niche] + [thing you help your clients do]. Give me 20 blog post topic ideas.

Example: I’m a financial advisor who helps doctors plan for retirement. Give me 20 blog post topic ideas.

Try It Here!

How do you like this new Sunday Brew format?

Click below to let us know:

👍 | 👎

Always be growing,

Jeremiah D. Desmarais

CEO, Advisorist

www.advisorist.com

#1 in ROI-Driven Training for Advisors