“Growth and comfort do not coexist.”

Hey Sunday Brewers!

Here’s a taste of what’s inside this edition of the Sunday Brew:

✅ 73% of THIS generation feel financially strained, new report finds.

✅ Bed Bath & Gone? Store closures to spark massive retail ‘land grab’

✅ Lunch, light bulbs, & ice cream…the future of retirement planning?

✅ ChatGPT….the future of financial advice?

The First Sip: ‘…So You’re Telling Me There’s a Chance?’

Doctors told 44-year-old Lucy Humphrey that she had 5 years to live and that her chances of finding a kidney donor match was 1-in-22 million.

Lucy spent several years on the waiting list until a totally random encounter quite literally saved her life.

One weekend, Lucy decided to take her dogs, Jake and Indie, with her to Barry Island Beach for the day.

And the strangest thing happened…

Indie kept running off down the beach to a stranger 100 yards away and wouldn’t leave her side.

“Indie went over like three times, back and forward to her,” Lucy recalls. “Eventually we went over to apologize and got chatting and invited her over to our barbecue.”

As they chatted, Lucy mentioned that she couldn’t drink alcohol because she was on dialysis.

In that conversation, the new friend, Katie James, revealed that she had just joined the kidney donation register.

Lucy and Katie swapped numbers, but didn’t really think much about it.

But then the blood tests and scans came back…and it was a perfect match.

“A surgeon told us it’s a 1-in-22-million chance to find the perfect match, and that’s what I needed.”

The transplant took place in October of last year and the unlikely trio of Katie, Lucy…and Indie remain good friends.

73% of THIS generation feel financially strained, new report finds.

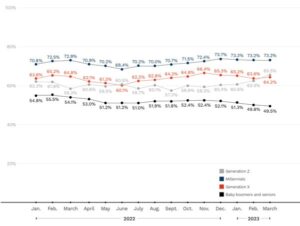

While the percentage of American adults living paycheck-to-paycheck dropped from 62% to 60% this month, certain generations are feeling it more than others.

LendingClub reports 73% of adults ages 27 to 42 are dependent on their next paycheck to cover all of their bills.

And with stagnant wages and ballooning inflation, the road ahead looks a bit rocky.

|

Related: Is Gen Z poised for a financial breakthrough? While millennials are on the struggle bus, a study claims slightly younger Gen Z’ers are the “most financially savvy” generation in the U.S. |

|

Members of Gen Z – the oldest of whom are in their early-20s – are the most likely to review what’s coming in and going out of their bank accounts each day. They’re also more likely to use financial apps and technology for managing saving, spending, and investing. 👍 But it’s not all rainbows and butterflies for Gen Z, as a poll of business owners and managers say they’re the most difficult generation to work with. That puts them at the top of the “firing list” for most bosses. 👎 |

Bed Bath & Gone? Store closures to spark massive retail ‘land grab’

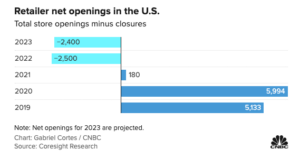

The Bed Bath & Beyond saga is expected to culminate soon, as the company’s bankruptcy filing will likely result in the closure of nearly 500 stores over the next several months.

According to analysts, this will set up an unprecedented “land grab” as other retailers – particularly low-price chains and dollar stores – look to gobble up the spaces they leave behind.

Lunch 🍔, light bulbs💡, and ice cream cones🍦…the future of retirement planning?

There’s a 50% chance that Americans who are 65 years old today will make it to see their 85th birthday – a stretch of 8,000 days representing ⅓ of their adult life.

Author Joseph Coughlin argues this increased life expectancy requires a rework of the way we plan for retirement, saying, “This is an entirely new longevity frontier.”

According to Coughlin we have to look beyond the classic notion of measuring retirement as “savings” and “time” and explore a more complete framework that answers 3 questions:

1️⃣ How will I get an ice cream cone?🍦

2️⃣ Who will I have lunch with? 🍔

3️⃣ How will I change my light bulbs? 💡

👉 Here’s why these questions matter.

ChatGPT….the future of financial advice?

A new university study shows the revolutionary AI tool, ChatGPT, is surprisingly accurate when predicting stock market moves.

In the study, researchers fed the chatbot more than 50,000 news headlines about companies dating back to October 2021.

ChatGPT evaluated whether the news was good, bad, or irrelevant to the company’s stock price. Based on this sentiment analysis, each stock was given a score predicting the company’s stock performance the following day.

The result?

Companies with higher scores had better returns than those with lower scores.

ChatGPT outperformed traditional sentiment analysis methods in impressive fashion.

The results were so impressive that Bloomberg has recently released a GPT-based language model called BloombergGPT, which is specifically trained to examine financial documents, statements, and filings.

Enjoy your Sunday,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors