Overheard on Twitter…

“The only person you are destined to

become is the person you decide to be.”

–Ralph Waldo Emerson

In this week’s email:

- The latest industry trends and economic outlook based on a massive survey of advisors

- Why the way you talk could be turning prospects AWAY (and 1 quick solution)

- How a shift in California’s unemployment rate could signal a nationwide recession

- …and the headlines we’re reading this week.

PS – Our resident neuroscientist told us to move the dopamine-inducing “Best Thing I Saw All Week” to the END. So you have that minty fresh feeling once you’re through the news. Hit reply and Tell us what you think at the end!

Markets 📈

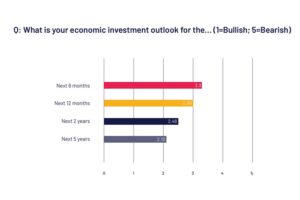

Advisors *Almost* Bullish (Study)

Giphy. Family Guy

A majority of advisors are interested in alternative investment vehicles for clients, but the lack of liquidity and overall cost is concerning.

That was just one key finding in this year’s study by the Financial Planning Association and Journal of Financial Planning.

Overall, investment professionals have a lukewarm outlook on the overall economy in the near term (with a more bullish outlook over the next five years).

Other noteworthy bits of data:

🔹 90% of investment professionals say they use or recommend ETFs for their clients

🔹 Nearly half of investment pros plan to increase ETF usage over the next 12 months

🔹 More than 70% express confidence in the traditional 60/40 portfolio’s ability to provide similar returns as it has historically

🔹 Just 2.8% of advisor are recommending crypto for clients, while 7.9% encourage investing in precious metals

More Market Reading 📈 |

💰 Warren Buffett is buying Japanese stocks. Should the rest of us?

📉 6 predictions for mortgage rates in 2023 (including the possibility of dipping below 6%)

🟫 Could the looming UPS strike deliver a serious economic blow to US economy?

🚀 Don’t look now, but Bitcoin is having a great year (and support is rising)

📋 Department of Education announces student loan repayments to resume this fall

Industry Roundup 🧠

Okay, this probably isn’t what you want to hear, but I’m just the messenger…

Roughly 76% of Americans age 50 or older say they have “little or no confidence at all” in retirement products.

But here’s what’s interesting…

According to a new survey, one of the biggest drivers for this insecurity is complex financial jargon.

In other words, it’s the way we TALK about retirement products.

1-in-3 Americans say the way advisors explain products overwhelms them to the point that they don’t feel good about investing.

In fact, only 30% of people even bother to seek guidance from a professional advisor.

Giphy. Arrested Development

While there are other reasons for concern around retirement planning – including worries over inflation and healthcare – these are not factors that advisors can control you can play at bada78.com xD.

We can, however, control the way we communicate, educate, and engage.

Here’s a quick suggestion for you 👇

- Write up a quick 1-page document explaining the retirement products you offer clients.

- Open up ChatGPT

- Use this prompt: Rewrite the following so that a 5th-grader could understand it. Use analogies to make it easy to understand. Replace all financial jargon with simple terms.

- Paste in your one-page document

- Click enter

Watch and be amazed.

You can clean up the results a little bit to fit your voice and start using these analogies and terms to be more relatable with prospects and clients.

(PS – we did have to tell it to take out the words ‘magical’ and ‘special’… but see what it does for you)

More Industry Reading 🧠 |

🤖 AI Is Coming For Wealth Management: Here’s what that means

📊 Simple graphic for showing clients how to avoid withdrawal penalties for retirement accounts

🧠Making the case for life insurance policy appraisals (3 myths debunked)

❤️A look at why Boomer Clients LOVE them some equities

Deep Dive 🔎

ANOTHER Recession?

What a strange time to be alive.

Topsy-turvy markets…crypto bubbles (and resurgences)…artificial intelligence…sky-high inflation…

It’s easy to feel like this is all normal when we’re living in it.

But zoom out and you get a little more perspective on just how wild the marketplace is.

Here’s another interesting dichotomy…

Despite the Fed ramping up interest rates in an effort to neutralize inflation, U.S. unemployment rates have dropped to historically low levels over the past couple of years.

But that’s no longer the case in California, where experts say a spike in unemployment means a rocky economic road ahead.

More specifically, the unemployment rate in California rose from 3.83% in August 2022 to 4.5% in May 2023, outpacing the national rate of 3.7%.

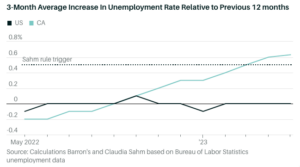

Per the widely recognized “Sahm Rule” – named after economist Claudia Sahm – this increase in the state’s 3-month moving average places California on the brink of a recession.

“California’s current unemployment rate, and particularly the changes in that rate in the past year, are ‘blinking yellow,’” she says.

Thankfully, the national 3-month moving average has remained pretty stable thus far in 2023.

But experts warn against getting too comfortable.

One leading economist who predicted the bank failures this spring says a full-blown national recession is just around the corner.

And other countries aren’t exactly helping either.

Between Germany, New Zealand, and possibly China…global troubles make a swift recovery for the U.S. even more challenging.

The Best Thing I Saw All Week

Siobhan Bon and her daughter Indie were shopping at a mall in Sheffield, UK this past week when a random act of kindness gave them both hope.

Indie, who is currently undergoing cancer treatment in her battle with leukemia, was shopping in the Apple Store when it all happened.

A man came up to her and said, “My son had cancer. I know how you’re feeling. I’ve got something for you.”

He proceeded to hand her £100, revealing that his son has now been in remission for 10 years.

”We were both absolutely bawling our eyes out, cuddling in the middle of the Apple shop,” Siobhan said. “Everyone was looking at us, but for that minute someone knew exactly how I felt.”

Indie lightened the mood a bit when she screeched: “Mummy, I’m rich!”

The £100 meant Indie could afford to load up on skin-care products and new makeup, which she loves to use when creating TikTok tutorials.

“I never got his name, and I so wish I did,” Siobhan later wrote on Facebook. “If you see this, thank you!”

In this together,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors