“Live as if you were to die tomorrow.

Learn as if you were to live forever.”

– Ghandi

In this week’s email:

.

- One small, hidden metric from Friday’s job report that nobody is talking about

- Report: Is the insurance industry about to explode? 🚀

- 🤷 Financial Planner Shares 3 Reasons She Doesn’t Trust AI To Manage Money

PLUS…everything we’ve been reading and watching this week!

Markets 📈

The U.S. Jobs Report was published on Friday, giving off mostly positive vibes heading into the weekend.

It was so strong that one respected economist said, “There is nothing to suggest a recession is near.”

Even the Federal Reserve staff has pushed back its forecast – now anticipating a recession that starts in October and lasts through March 2024.

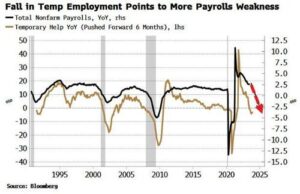

However, there’s one small, hidden metric in Friday’s report that Bloomberg Macro Strategist Simon White says speaks to the contrary.

“Temporary help” – that is the number of short-term temporary hires that employers bring on to help them meet demand – is on the decline.

In fact, as the chart above shows temp help has now been contracting on an annual basis for most of the year (with more to come).

Firms are not only cutting temporary employees, they are reducing hours worked (also typical of what happens before firms start to fire people).

On top of this, the average weekly hours worked of all employees has been steadily falling.

So while most are celebrating an overall “positive” Jobs report, it’s important to remember that these things aren’t always black and white.

More Market Reading 📈 |

⚠️ IRS warns taxpayers of new ‘unclaimed refund’ scam – here’s how it works

💸 Bitcoin ETFs: What They Are and Why Their Approval Will Increase Price

🚗 “People Swimming In Debt”: Record # Of People With $1K Car Payments

🔼 Mortgage rate soars to 7.22% after strong economic data

👍 SEC seeks rule change that could cause fund managers to take less risk

👩 Women may soon hold majority of jobs in the U.S. again

🤯 Your standard of living in retirement is largely determined by this surprising thing

📉 U.S. bank lending falls in latest week, Fed says

🤔 How much do you need to be financially secure? Americans now cite surprising salary

😬 Oops! Error that would cost taxpayers $352M spotted in tax cut bill

Industry Roundup 🧠

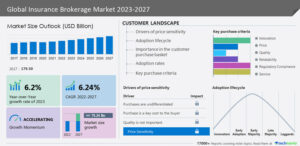

A new report predicts the worldwide insurance brokerage industry is projected to grow by an impressive $75.24 billion between 2022 and 2027.

During this 5-year insurance “bull run”, the market’s growth pace will accelerate at a CAGR of 6.24%.

Several sectors, including accident, life, medical, vehicle, liability, and property insurance, are already experiencing heightened demand – something that will only continue in the years to come.

Where is the uptick coming from?

Experts say heightened awareness due to better education from advisors and agents is a huge factor.

The data shows that advisors who take the time to explain the benefits of different policies (and the risks of NOT taking action) tend to do better than those who assume people already know what they’re talking about.

More Industry Reading 🧠 |

😬 Former FA Gets Eight Years in Prison over $1.9M Scheme

🤔 30M People Joined Threads Overnight. Will Advisors Get on Board?

🤖 7 Top Investment Firms Using AI for Asset Management

🤷 Financial Planner Shares 3 Reasons She Doesn’t Trust AI To Manage Money

☮️ Are financial advisors are part-time meditation coaches?

📈 Insurance Brokerage Market to grow by $75 billion from by 2027

📊 Insurance study shows 80% of policyholders rely on recs from friends10 High-Wage Cities Where Advisors’ Salaries Go the Furthest

The Best Thing I Saw All Week

What kind of persona do you think about when you hear the name Kevin Bonecutter?

A WWE Wrestler? Or maybe a mobster from the 1940s?

How about a Cincinnati man with a heartfelt campaign to do 143 random acts of kindness in 40 days? ❤️

Probably not what you were thinking 😂

Kevin kick-started his kindness journey on June 1st…

And over the past month, he’s been tirelessly mowing lawns for vacant properties, cleaning up litter in his neighborhood, and giving away snacks and drinks to homeless people nearby.

After neighbors started noticing, Kevin was approached by a local journalist to uncover his motivation for the 40-day kindness spree.

He says the number 143 is an ode to one of his childhood heroes, Mr. Rogers, who had a unique way of conveying “I love you.”

He would sing the number 143, with each digit corresponding to the number of letters in the word – I (1) Love (4) You (3).

“The whole idea is to be out here spreading 143 random acts of kindness, but really spreading love and kindness throughout the entire community,” shared Bonecutter.

“I want to inspire other people to also say, ‘Yeah, I want to do this as well,’ and let it be a ripple effect.

There’s enough negativity, let’s start some positive ripples and see how far it can go.”

Be kind,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors