No big intro, buildup, or backstory here.

I have so much GOLD in this blog post that I don’t want you to get distracted before you get to the meat.

But I will tell you this…

By the time you finish reading this blog post, you’ll have learned the following:

- The undiscovered app that an advisor used to pick up 15 new clients and $210k in lifetime commissions in just 2 weeks. (Including a secret tactic YOU can use to turn webinar no-shows into warm leads.)

- How one advisor is getting a 37.5% LinkedIn connect acceptance rate and turning them into email prospects.

- 9 ways advisors can stay top of mind while prospects and clients are stuck at home.

Plus, if you stick around until the end…

I’m going to show you how to get your hands on a free BONUS cheat sheet with a strategy a 70-year-old advisor is using to generate thousands in commissions via a fully automated process.

Sound good?

Let’s get to work 💥🔨

3 White Hot Tactics For Insurance and Financial Advisors

If you’ve been around the Advisorist community for any time at all – whether in one of our paid programs, on the blog, or in our Facebook Group, you know that our team likes to give away massive value.

It’s just part of what we do.

And while we have backlogs of powerful content, frameworks, and tools that we’re planning to unleash over the next few months, I’ve learned that sometimes it’s best to listen to you guys – the insurance advisors and financial advisors on the frontlines – and study what’s working RIGHT NOW.

To do this, I like to carve out time in our weekly Virtual Advisor Power Hours to let you all share the strategies and tactics you’ve been using over the past few days.

And that’s what this blog post is all about.

Here are three amazing hacks and tactics that three different advisors across the country are using to reach, engage, and convert.

Enjoy the feast.

1. Using a Relatively Unknown App to Re-Engage Webinar No-Shows

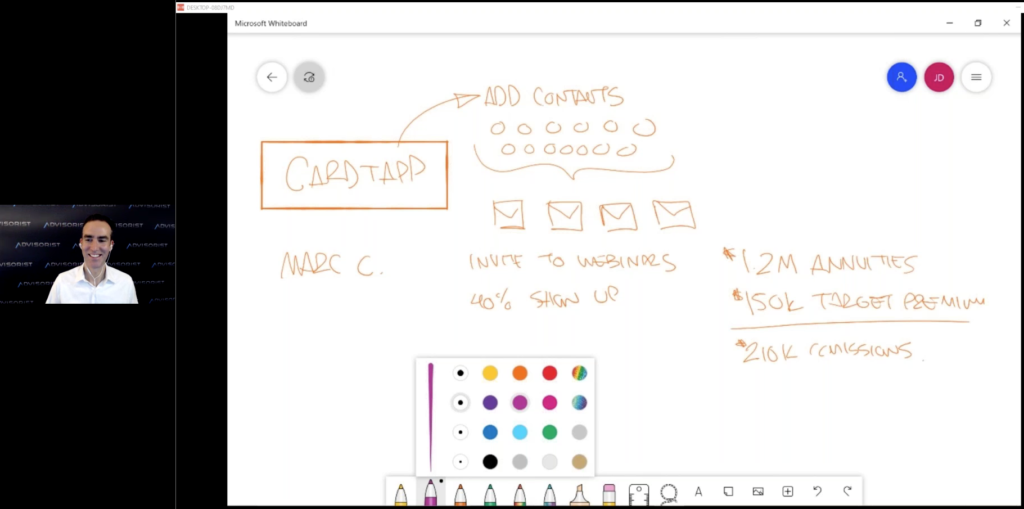

Marc C., who is an advisor in the New Jersey area, recently discovered an app called CardTapp.

He told me the first time he heard about it was three weeks ago.

And for just a few hundred bucks per year, he’s discovered a way to reach re-engage prospects with very little time, effort, or energy. (There’s some very quick setup on the front end and then he doesn’t touch anything.)

In just two weeks of using CardTapp, Marc has generated 15 sales worth $1.2 million annuity sales + $150k target premium.

That amounts to an estimated $210k in lifetime value (commissions).

Want to know how he did it?

Well, of course you do!

Here’s the basic gist of what he’s done:

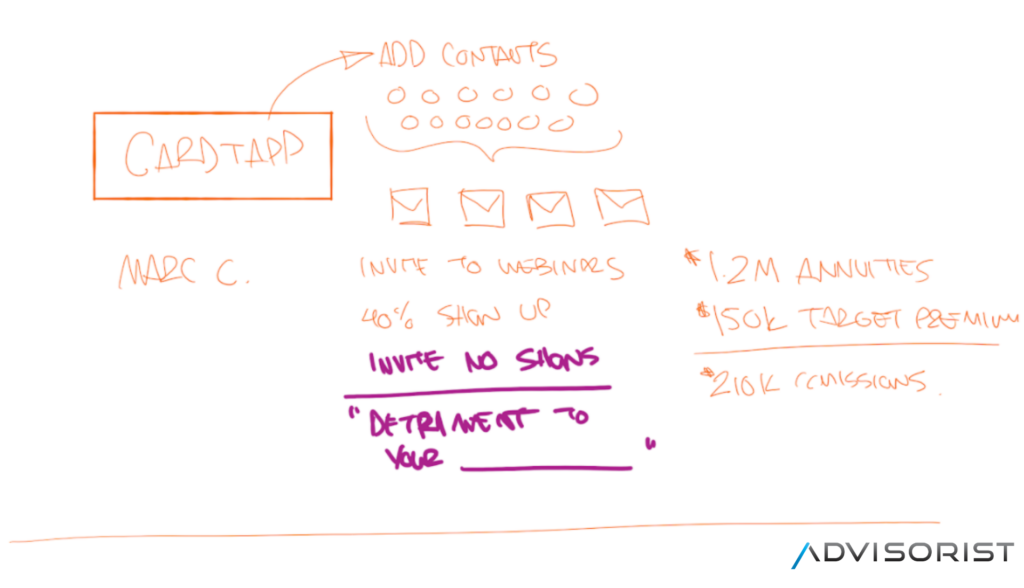

- Marc went back and reviewed his past webinar registration information. He saw that 60% of leads who signed up never showed up or dropped off. He still had all of their information so he plugged them into the CardTapp system.

- He then sent a message to these prospects asking them to text “incomeplanning” to a five-digit number. This took the prospect through a very short and simple series of prompts that asked them if they’d like to add it to their home screen. (Once added to the home screen, the app brings up his virtual business card. And it stays there until the user removes it from their phone!)

- Once connected like this, Marc was able to share content – including video – to nurture, set appointments, and stay top of mind.

- To re-engage his leads, Marc sent a simple message that read something like this: “You signed up for a workshop in the last month and I noticed that you didn’t show up. There’s some information in there that you missed out on that could be a detriment to your future. Please call me.”

So just to recap for you…

Marc learned about this app three weeks ago.

He plugged in some leads he already had on file (but who weren’t engaging).

He spent a few minutes coming up with some messaging.

Then he let CardTapp do its thing.

And now in a matter of a couple of weeks, he’s generated an estimated $210k in lifetime commissions.

All for an investment of a few hundred dollars.

I’d say that’s worth a try….wouldn’t you?

2. A Strategy for Improving LinkedIn Connect Acceptance Rate and Taking the Conversation Over to Email

Rich J. is a 29-year-old independent advisor who started a scratch book of business about three years back.

He’s a “young gun” as they say.

But he’s poised to absolutely KILL it over the next few years.

Rich attended the Virtual Financial Advisor Summit that we co-produced back in May and was really motivated by Tom Hegna’s presentation where he talked about there being “riches in niches.”

That talk, combined with some of the other high-powered content, compelled Rich to take a hard look at his branding.

In particular, he started focusing on improving and optimizing his LinkedIn profile.

Up until that point, he was kind of taking a generalist approach to prospecting.

But he sat down and thought to himself…

“Who do I really want to work with?”

Pretty quickly, he realized the answer was “aspiring first generation affluent.”

That led him to realize he needed to overhaul his LinkedIn profile so that he could begin reaching those individuals.

And that’s exactly what he’s done.

He’s started a LinkedIn funnel.

He began with a list of about 200k names in his local area.

Then he diluted that down to roughly 5k people who had recent job changes.

His train of thought was this:

If people have changed jobs within the last 90 days, then it presents a great opportunity to start a conversation about 401(k) rollovers and then eventually pivot into what a comprehensive plan looks like long-term.

He’s used this strategy to shoot out 800 targeted connect requests.

From that, he’s connected with 300 prospects.

That’s an acceptance rate of 37.5% – which is far above the 20% to 30% that a lot of advisors are seeing on LinkedIn.

Rich is then funneling these connections into live webinars where he aims to set up appointments.

Amazing results – all from niching down, rebranding, and targeting the right people.

But Rich isn’t satisfied with just connecting and nabbing a few webinar attendees.

He wants to make sure he’s maximizing his efforts.

So he asked me a question in the recent Virtual Advisor Power Hour.

Armed with 300 new email addresses (taken from the new LinkedIn connections), he wanted to know how he could transition the conversation over to email and increase their chances of signing up for a webinar.

And here’s the precise four-step action plan I laid out for him:

- Take the message you used on LinkedIn and tweak it to send via email.

2. Keep it very relaxed and invite them to a “live class” or “training.”

3. Establish a degree of selectivity by letting them know that you’re only sending this offer to your 1st degree LinkedIn connections.

4. Try a 50/50 split test with your emails. For the first half, say: “Would you like me to send you an invite?” For the second half, send a direct link to the live class or training. Take the one that performs best and send it to the rest of the prospects on your list.

Knowing that Rich already has the right prospects on his list, I’m confident that this approach will work for him.

But I’m also pretty confident it’ll work for you, too.

As long as you stay out of his market , I don’t think Rich will mind if you nab this one out of his playbook! 😂

3. Staying Top of Mind In Your Market When Prospects Are Stuck at Home

With so many people still unwilling or unable to meet in person, how do you continue to engage prospects and clients by remaining top of mind?

It’s a question we’ve all had running through our heads this year.

And I want to give some major kudos to advisor Elizabeth L.

Rather than trying the same old tactics that everyone else is doing, she thought outside of the proverbial box.

Back at the start of the COVID shutdown – when people were only leaving the house for groceries – Elizabeth had the brilliant idea of hosting a virtual dance party for her clients’ and prospects’ kids.

She sent out personal invites via email and simply offered to put on a virtual dance party so that parents didn’t have to worry about watching their kids for an hour.

And it was a BLAST.

She found videos on Youtube.

Made a fool out of herself. (Her words, not mine.)

And had fun.

There was no sales pitch.

No mention of anything related to stock markets, retirement, insurance, etc.

It was purely a relational touchpoint.

Nothing more and nothing less.

I know most of you probably aren’t the virtual dance party “type” – and that’s okay.

I’d never want you to do something that was out of character or off-brand.

But there are plenty of other ways you can stay top of mind.

Here are nine ideas I came up with:

- Virtual game night. (Here are a few games ideas for inspiration.)

- Group hangout where you watch a movie together.

- Trivia night. (Find an online group trivia game and have some fun.)

- Group cooking challenge with two or three couples.

- Weekly money update on the markets.

- Monthly business entrepreneur networking power hour.

- Do a mastermind for members of your target audience. (Once or twice per month.)

- Virtual “Wine & Wisdom” social hour with clients.

Pick one of these ideas or create your own.

The important thing is that you identify opportunities to engage with clients and prospects and stay top of mind at a time when attention spans are on sale.

Bonus: Claim Your Cheat Sheet Strategy

Okay, I made you a deal at the start of this blog post…

I promised that I would reward you for reading through to the end by giving you access to a free BONUS cheat sheet.

But it’s not just any cheat sheet.

It features an incredibly clever strategy a 70-year-old advisor is using to generate thousands in commissions via a fully automated process.

And when I say automated, I mean you spend a few minutes setting it up and then barely touch it again.

Plug your email address in below and I’ll deliver it straight to your inbox.

[optin-monster-shortcode id=”k3sqctqpf6wyte1jeh11″]

If you loved tips and strategies in this post, then you’ll LOVE our FREE Virtual Advisor Power Hours.

They take place every Wednesday afternoon at 12 noon ET.

Hear from top producers and experts – as well as your fellow insurance and financial advisors – and get strategies, frameworks, and swipe files to build your own appointment engine.