I spend a lot of time in the “lab” studying what’s working in our industry.

Over the years, I’ve spent millions of dollars of my own money learning and testing every technique under the sun to see what works.

And here’s what I know:

LinkedIn is THE #1 most underutilized sales and prospecting platform in the industry.

That’s not my opinion – that’s a fact.

Consider that:

- 90 million senior-level influencers are on LinkedIn

- More than 60% of users in the U.S. have an income of $100k or more

- 2 of 3 investors with investable assets above $100k (and 37% of those with $5M in investable assets) are spending regular time on LinkedIn each week

- 73% of investors are going to LinkedIn to research financial decisions

Despite this, very few advisors – somewhere between 2% and 3% by my guess – are doing LinkedIn well.

This lack of adoption leaves a HUGE opportunity for the advisors who roll up their sleeves and get to work.

In fact, the data shows that advisors who prospect on LinkedIn achieve a 62% success rate.

And out of those advisors who are successful with the platform, 1 in 3 gain $1M in new AUM.

But can I let you in on a dirty little secret?

There’s something that holds most advisors back from achieving results like these. (And if you can work through it, you’re essentially guaranteed success.)

The Importance of Niching (For Insurance & Financial Advisor Marketing)

Few in our industry are willing to be so blunt about it, but I’m not going to sugarcoat anything…

Most insurance and financial advisors have vague, uninspired branding (and it’s hurting their ability to reach affluent qualified prospects).

BUT…and this is the good news…those who are able to overcome this weakness and clarify their branding see an immediate boost.

Our team here at Advisorist has coached hundreds of advisors and helped them generate more than 13,451+ appointments via LinkedIn.

Over that time, we’ve found that the #1 thing our top insurance and financial advisor students have in common is a well-defined niche and unique selling proposition (USP).

And niche and USP are more important than ever in the virtual age (accelerated by COVID).

If people don’t understand what you’re doing in order to help them, they’ll go with someone else. (And possibly the advisor down the street.)

You MUST have a defined niche and a compelling USP…otherwise, you’ll continue to snack on everyone else’s leftovers.

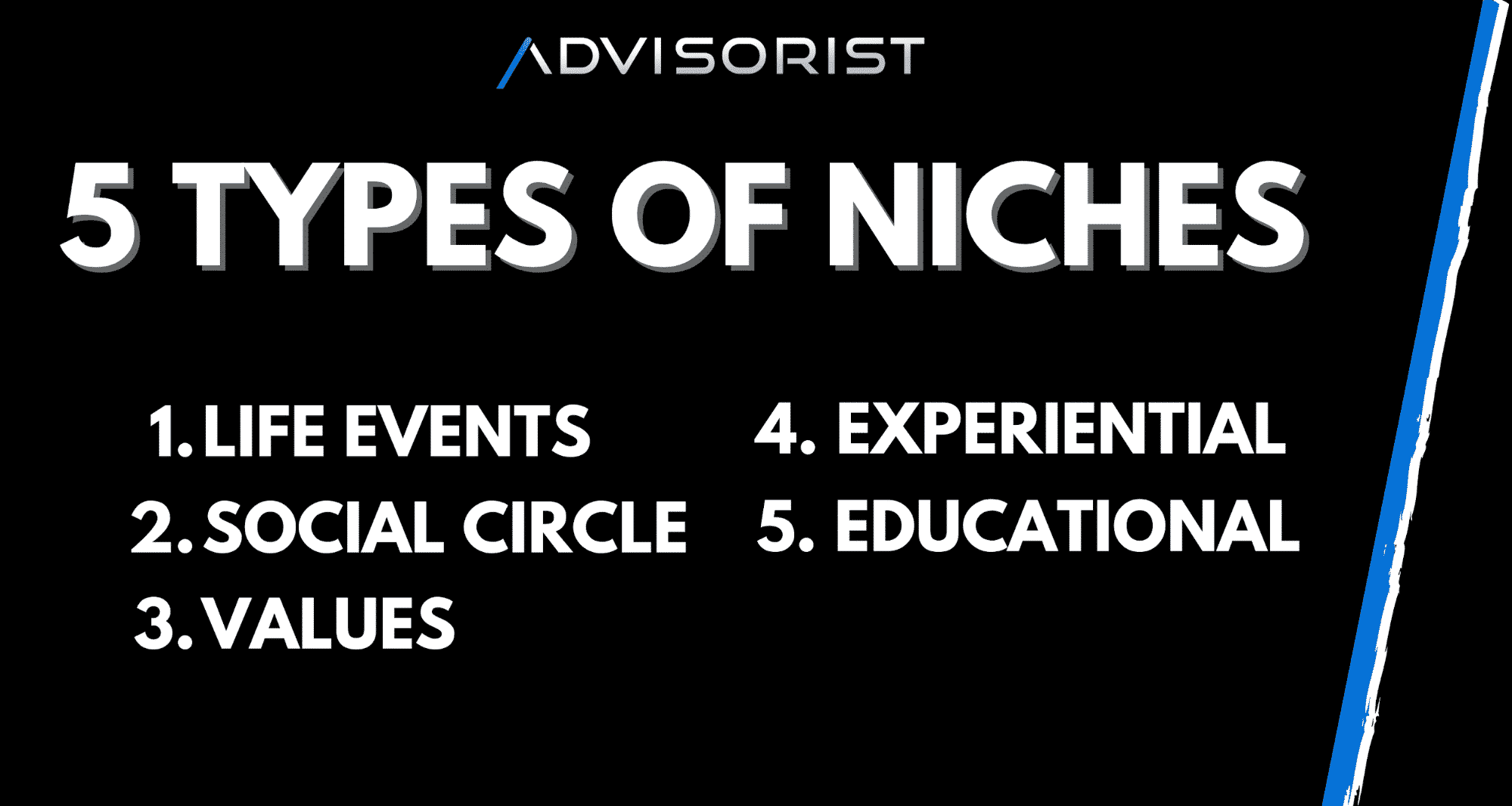

5 Types of Niches

It’s been said that there are five different types of niches that insurance and financial advisors can go after:

- Life Events. Sometimes you may find it helpful to zero in on a particular life event – like managing a job change in the middle of your career, or preparing for an early retirement.

- Social Circle. This niche is all about targeting people who are in a common social circle. (Such as members of your local country club.) People trust other people who run in their same circles.

- Values. When you have a shared philosophy with someone, they’re more apt to trust you. Examples include religious values, social causes, or even political persuasions.

- Experiential. It’s possible to create a niche by offering a unique experience that nobody else does. This could be a proprietary financial planning process or a unique meeting strategy.

- Educational. Sometimes graduating from the same college or university creates a powerful bond. People who have a similar educational background tend to flock together. Perhaps you could go after a specific educational demographic?

These are NOT niches in and of themselves…simply categories of niches. Keep them in mind as you home in on your own.

Tips for Choosing a Niche

There are literally thousands of different niches for you to choose from. But you don’t want to choose just any target for your financial advisor marketing plan.

You want to select a niche that’s specific to your vision AND lucrative.

You want to carve out a 7-figure niche.

And while it certainly requires some effort, it’s not as impossible as it may initially seem.

Here are a few of our favorite tips:

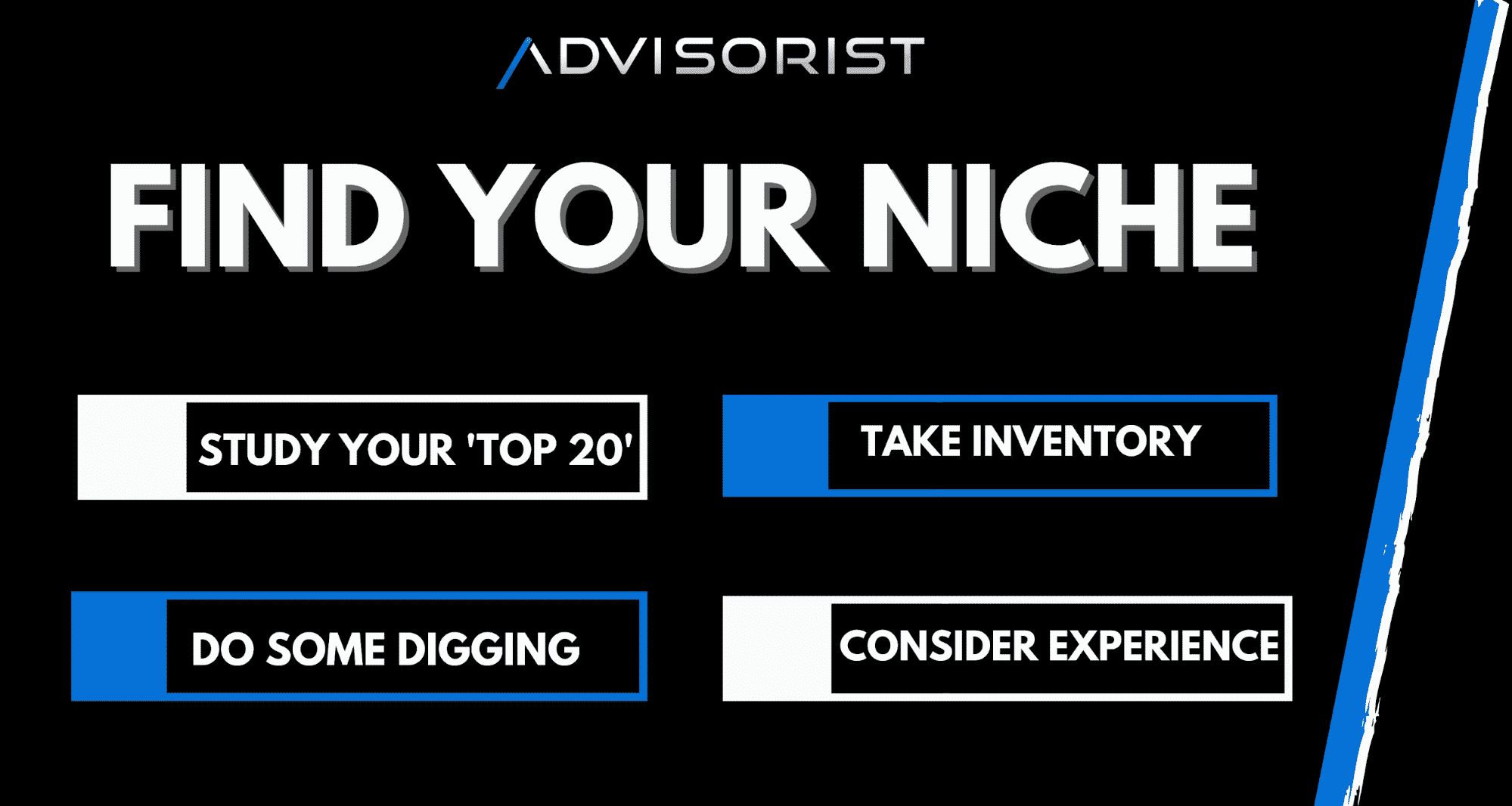

- Study Your ‘Top 20’

Sometimes you’re already in a niche and you just don’t realize it.

Open up a new spreadsheet and create a list of your top 20 clients.

Now go through and jot down notes about their industry, age, location, lifestyle, where they came from, etc.

The goal is to uncover a couple of threads of commonality.

In doing so, it’s possible that you’ll stumble upon a specific recipe that each (or most) of your top clients have in common.

Boom! That’s your niche.

- Take Inventory of Your Interests

Another method is to take a few minutes and conduct deep introspection.

What are YOU interested in?

What do YOU daydream about?

What hobbies are YOU active in?

Don’t make this more complicated than it has to be. The first things that come to mind will probably be the most authentic.

When you choose a niche based on your interests, it’ll feel like less work. You’ll naturally rub shoulders with prospects at every turn, plus you’ll already know how to speak their language (because it’s YOUR language).

- Account for Past Experience

Some of the most successful niches I’ve seen are ones that leverage past experience.

If you had a past career before becoming an insurance or financial advisor, it could be a good niche.

Examples include serving in the military, playing college/professional sports, working in a specific government position, flying planes, etc.

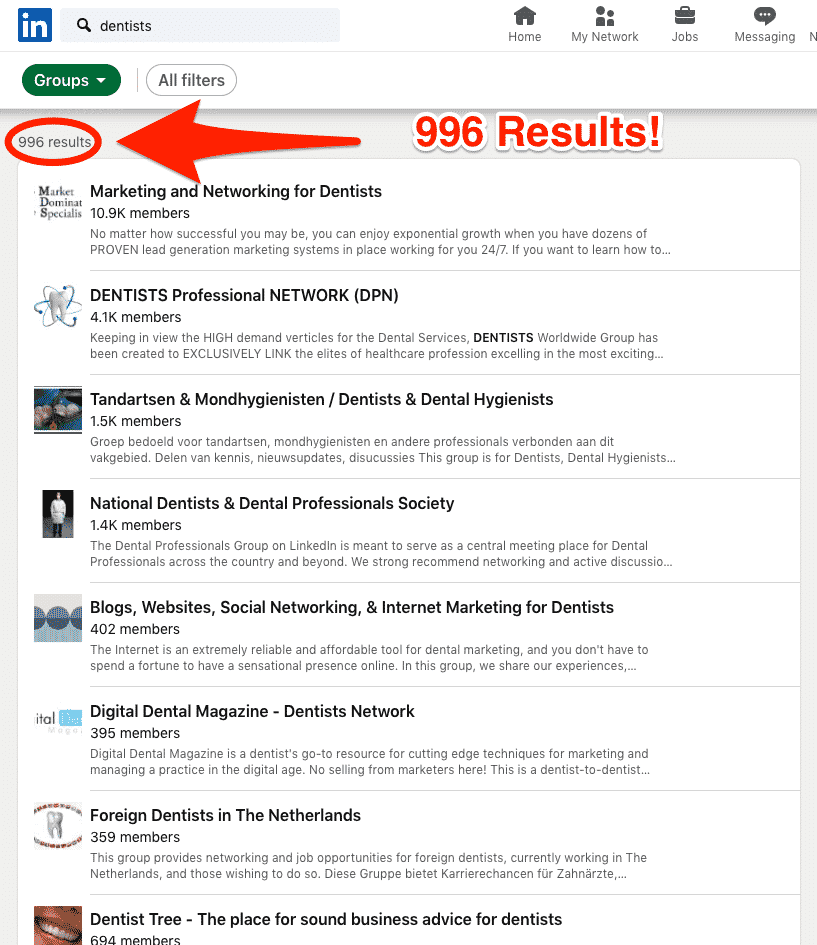

- Do Some LinkedIn Digging

One of my favorite “ninja hacks” for finding possible niches is to mine LinkedIn Groups.

All you have to do is plug in a keyword, like “dentists” and you’ll get hundreds of results for groups that relate to your search. (In this case, there are no less than 996 groups about dentists.)

Use this as social proof that a niche exists. Then you can get even more focused by choosing which types of “sub” groups offer the most potential.

Developing a USP That Resonates With Your Niche

Discovering a niche with 7-figure potential is the first step to clarifying your financial advisor marketing strategy on LinkedIn.

The second step is targeting that niche with a USP that’s so powerful prospects have no choice but to engage with you.

At Advisorist, we teach all of our 7-figure clients to use a simple USP formula to resonate with their audience. It looks like this:

“I help [TARGET AUDIENCE] to [INSERT DESIRE THEY HAVE] without the [INSERT PAIN THEY WANT TO AVOID].”

The best way to land on your USP is to think about:

- What you do well

- What your competitors do well

- What the consumer wants.

The “sweet spot” lies in the overlap of what you do well and what your consumer wants, but exists outside of what the competition does well.

In other words, you want to meet an unmet need using expertise/branding that you possess and your competitors do not.

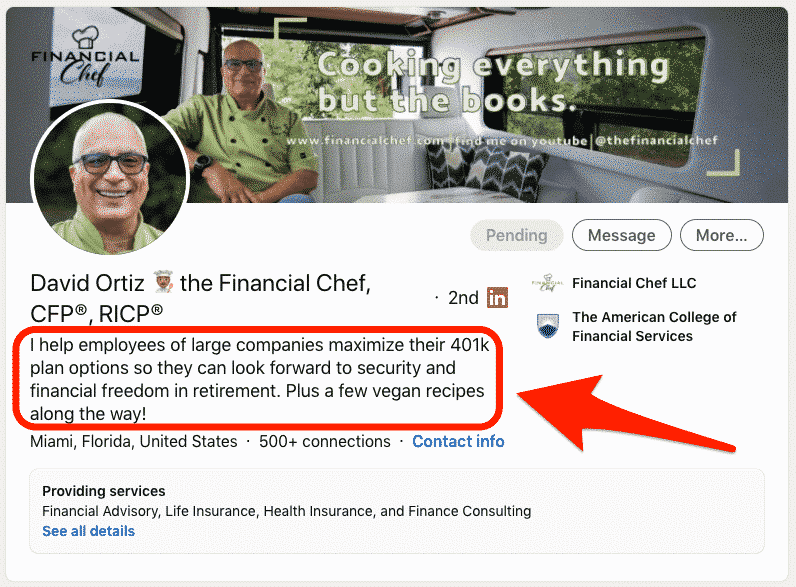

Financial advisor David Ortiz is one of THE best examples I can think of.

Not only does he have a laser-focused niche, but he has an incredible USP to boot.

His USP is “I help employees of larger companies maximize their 401k plan options so they can look forward to security and financial freedom in retirement. Plus a few vegan recipes along the way!”

If you’re someone who is in his niche, there’s almost no confusion – you know it right away.

As an advisor, you need to get THIS ^^ specific with your niche and USP, otherwise you’re treading water.

Unearth More Golden Nuggets [FREE]

Whether you’re a seasoned advisor who senses a major shift in the industry and a need to adapt, or you’re a bright-eyed “young gun” who is looking for some direction on how to build a successful practice, I consider it my mission to help you grow.

At Advisorist, our aim is to help 10,000 insurance and financial advisors double their businesses and take 100 days off per year.

One of the ways we do this is by offering FREE weekly masterclasses where we dissect proven insurance and financial advisor marketing strategies we’ve used to help advisors generate millions of dollars in fees and commission over the past few years.

(That includes concepts like the ones you read in today’s.)

4 Responses

As usual, good stuff Jeremiah. Keep it coming!

Love to join and learn

Thanks for reading, Brett! You can add all future Virtual Advisor Power Hours to your calendar by registering here (free): https://virtualadvisorph.com/join

Looking forward to “seeing” you around!

-Sky Richardson (Team Advisorist)

Several years ago, I named my company “The IRA Specialists,” thinking that it would distinguish me as an expert with IRAs. I’d say that I am a pretty good IRA geek, but I wonder if it’s narrow enough to call it a niche. I hate the thought of going through a name change. When I see what Ed Slott has been able to do with his expertise, I think there might be hope for a specialty in IRAs, but my execution on making hay with it has been only so so. Suggestions?