The only thing spreading faster than COVID-19 is fear and uncertainty around how the virus will impact our health, economy, businesses, and relationships.

Everywhere you go – online or offline – it’s the number one topic on people’s minds.

Whether you’re in a Costco in California or a café in Milan, the Coronavirus is the talk of the day, week, month, etc.

So while you’re not a doctor – and you probably don’t have any medical opinion on the transmission or suppression of this dangerous virus – you don’t have the option of ignoring what’s happening.

You’re not in the insurance or financial services business – you’re in the TRUST business.

People trust the fact that you’re there for them no matter what. Whether it was six weeks ago when business was booming and everyone was happy, or it’s today when the stock market is crashing and death and sickness feel heavy in the air. Your clients need to see that you’re acting with purpose and intentionality.

But you don’t have to do this alone.

There are plenty of advisors in the industry who are already in the process of writing the playbook.

Let’s look at some of the strategies and tactics they’re using/plan to use – and how you can form your own COVID-19 response plan that prioritizes growth!

Strategy #1: Get Educated NOW!

COVID-19 is still a relatively minor issue in most parts of the United States, in that only a minuscule portion of the population has been directly affected thus far. But it’s not going to stay this way for long.

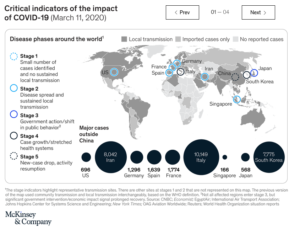

According to data from McKinsey & Company, we’re currently in Stage 2 of the disease’s spread. Stage 3 and Stage 4 – the toughest periods – are still ahead.

We can clearly see what’s coming and must prepare.

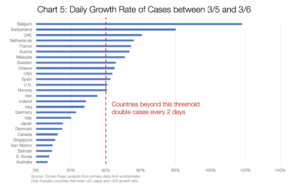

The United States has recently reached a threshold where cases are likely to double every two days. Thus it won’t be long before we stop talking about the potential of a domestic outbreak and we start experiencing an outbreak.

Use the time between now and then to get educated and create a response plan. (Get your facts from reliable sources – not opinionated Facebook friends!) Waiting until we have a full-blown national health crisis will put you behind the proverbial 8-ball.

Strategy #2: Encourage Your Team to Work From Home

Perhaps your team has talked to you in the past about working from home – or you’ve tossed around the idea as a way of offering more flexibility and cutting overhead costs. Well, now’s your chance!

You’ll be surprised by just how efficient the transition is. As long as you have some good communication tools in place – Slack, Google Drive, etc. – you should be able to carry on without much problem.

Strategy #3: Perfect Your Virtual Sales Skillset

While you won’t be doing many face-to-face meetings or sales pitches over the next few weeks, this is a great time to sharpen your virtual sales skills. In fact, this may be the single best strategy on this list.

Not only do virtual presentations make practical/logistical sense right now, but there are a confluence of factors that make it ripe for the picking.

Think about it.

As businesses and employers around the country continue to shut down, and more restrictions are put in place by local governments, your client base is going to be sitting at home. They become a CAPTIVE audience for you to engage and convert.

Most advisors are going to find that they get more answers and longer conversations, which ultimately results in better opportunities to generate leads, provide quotes, and write policies.

Even if you don’t pile up a massive book of new business, this will at least give you (and your team) a chance to get more comfortable with different virtual sales techniques.

Strategy #4: Prepare for Rate Shoppers

Predictably, the stock market continues to plummet as the number of Coronavirus cases increase. With no end in sight, this will lead many of your clients – particularly those who are inching closer to retirement – to review their financial situation and tighten down their budgets to stop the bleeding.

For insurance: Be prepared to have a bunch of rate shoppers contacting you to see where you can help them save. It’ll be helpful to think through some different scenarios in advance so that you can provide both existing clients and prospective ones with helpful insights and versatile options.

For financial advisors: Use this as a time to build their confidence in your expertise to weather the storm. Help them understand the big picture and convey the importance of not immediately selling off investments out of fear. While it may be time to move some investments around, this is not the time to sell off.

Other countries have already seen drop-offs in the number of new cases of Coronavirus. This has allowed them to ease back into some sense of normalcy. When this happens domestically, markets will slowly recover.

For younger clients who’ve only known a bull market, this might be a good opportunity to help them understand what a powerful buying opportunity steep sell-offs yield.

You know your clients. Address their concerns with steadiness and reason.

Strategy #5: Knock Out Your CE Courses

Are your continuing education requirements stacking up?

Do you have an inclination that your team members are falling behind, too?

Use some of the downtimes you have over the next few weeks to really focus in on your CE courses and credits. It might not be the most invigorating tactic on this list, but fast forward six or eight months and you’ll be glad you did.

Strategy #6: Spend Time With Your Family

Think about how busy the majority of the year is.

You’re at the office for 10 or 12 hours a day. Your spouse is working. Your kids are at school and extracurricular activities. If you’re lucky, you get a couple of hours of family time per week.

If you’re all going to be quarantined at home together, use this time well! Make the best of the situation and form some priceless memories.

Strategy #7: Make Sure Your People Are Okay

At the end of the day, you have to look out for your people and make sure they’re doing okay. Whether it’s a few quick phone calls, emails, or text messages, these little gestures go a long way towards making people feel cared for.

Remember what we said at the beginning of this article?

You’re not in the insurance or financial services business – you’re in the TRUST business.

This is your chance to prove that you aren’t just there to collect premiums, but that you actually care about their physical, emotional, and financial well-being.

Do You Have a COVID-19 Response Plan?

It’s impossible to tell what the long-term impact of COVID-19 will be on our world, country, or industry. For now, we just need to treat it with the weight it deserves.

You might not be in the healthcare business, but you still have a role to play.

What are you doing to keep building your business during the Coronavirus crisis? Do you have a growth-oriented COVID-19 response plan in place? Tell us below!