“Success is stumbling through failures with no loss of enthusiasm.”

– Winston Churchill

In this week’s email:

👍 Survey Says: Non-401k investing is more popular than ever

✅ The power move that gets prospects to confidently say YES

📊 The one platform advisors are flocking to in 2023

And a whole lot more…

The Best Thing I Saw All Week

When Brennan Gould’s 8th grade teacher unleashed a “Kindness Week Challenge”, he struck an unlikely friendship with 84-year-old Ms. Ann.

What started as a week of daily gift-giving stretched into five years of monthly flower, smoothie, and chocolate deliveries.

Every month, the two chocolaty confidantes spend time together, with conversations spanning high school drama to college dreams to memories of decades gone by.

Brenan’s mom, Traci, says they’ve become the best of friends.

He treats her like an adopted great-grandmother.

“The best thing a teenager can do is befriend someone elderly,” Traci says.

“I’m so glad our son has added more sunshine to her life. I hope he always remembers the joy he’s brought her, and his fun talks with her, keeps his kind heart, and thinks of others!”

Markets 📈

Discretionary investing outside of workplace retirement plans is more popular than ever, according to a new report from Broadridge.

The U.S. Investor Study reveals a “real democratization of the space,” with access to online trading apps and low-cost investment options leading more people to invest beyond their 401ks.

It’s a trend that started with the pandemic – particularly with Millennials and Gen Xers who otherwise don’t have much assets under management.

“People were home, with expendable money … and easy access to investment tools,” Broadridge’s Andrew Guillette says.

“It’s important to note that the dollars they are investing are smaller, but these are also people who will be generating wealth in the long term.”

Millennial AUM, while growing, was still just 5% of total investments in 2022, Guillette notes, while mass market households—those with less than $100,000 in investable assets—make up about 7% of total AUM.

Other interesting findings from the Broadridge study (2018-2022):

- Online investing rose by at least 13% across all age groups, with AUM in online investment channels also up by at least 10% across all groups.

- 47% of Millennials sought investment advice from apps, and 60% said they are likely to use a financial adviser in the next two years

- “Active Mutual Fund Investor” households—those with more than 1/2 of their assets in active mutual funds—made up 44% of households in 2022, a 14% decline from 2018.

👉 You can access the full report here.

More Market Reading 📈 |

🤖 Morningstar launches AI chatbot that could change the game

🏦 The average U.S. retirement income from SS is $1,827 per month

😨 71% of Americans are stashing away more cash in 2023

📈 Mortgage demand down 30% YOY as rates once again edge up

🧰 IRS’ proposed tax filing tool could disrupt billion-dollar industry

Mindset 🧠

A researcher ran an experiment to test which marketing message would encourage people to save energy:

- You can save $54 this month

- You can save the planet

- You can be a good citizen

- Your neighbors are doing better than you

Which one do you think won?

Surprisingly, the first three had no effect on energy saving.

But the fourth one led to a 2% decrease in household energy usage.

Why should you care about this?

Because it speaks to the human psychology of motivation.

As humans, we’re always operating with incomplete information.

So we look to others to determine what to do….then adjust accordingly.

Now, put on your financial advisor “marketing hat” for a moment…

This experiment shows that by framing messages in terms of what other people are doing, you can drive action.

Simply including social proof is often enough to move the needle in a positive direction.

Here are some ways to use social proof to help customers feel confident in their choices:

🧠 Testimonials

🧠 Reviews

🧠 Media mentions

🧠 Case studies

🧠 Cited data/stats

🧠 Awards & recognition

More Mindset Reading 🧠 |

🤔 Poll: Men consider themselves better at saving money than women

📱5 essential apps for financial advisors to check out

😫 Millions of millennials are missing this year’s stock market rebound

Deep Dive 🔎

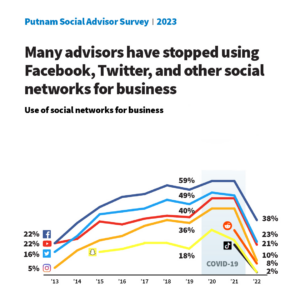

According to the latest Putnam Social Advisor Survey of financial advisors, many FAs have stopped using Facebook, Twitter, and other social networks for marketing.

If you look at that chart above, it appears that social media is not a viable strategy.

But that’s only part of the story.

Because that chart doesn’t include one important platform: LinkedIn.

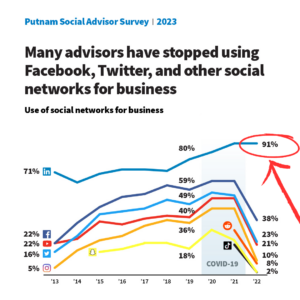

When you layer LinkedIn onto the chart, you see a totally different trajectory.

Not only is LinkedIn usage by advisors not declining – it’s going the opposite direction.

An impressive 91% of advisors are active on LinkedIn, which is basically an industry-wide “stamp of approval” that LinkedIn works.

And if you dig deeper into the data from the study, you’ll find that advisors who spend at least 60 minutes per week actively using LinkedIn are more likely to attribute success to social media.

As an advisor, there are two main takeaways from this study.

If you want to be successful with social media, you have to:

(1) Choose the right platform to invest in

(2) Consistently use that platform on a weekly basis

I’m not saying you can’t be successful on other platforms.

(For example, I think building a channel on YouTube is one of the best things you can do for your brand.)

But the data doesn’t lie, and there’s a reason 91% of advisors are using LinkedIn (more than at any time since the platform launched in 2003).

P.S. If you ever want to discuss what it would look like to build your own automated LinkedIn lead gen strategy, book a 15-minute chat with one of our coaches.

It’s totally free and they aren’t going to try and sell you anything on the call. (Though, they may be able to point you toward some good systems and tools.)

Be Well,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors