“Patience is the road to wisdom.”

In this week’s email:

🔨 Home Depot’s remarkable 14-year run is coming to a halt

🔥 Is the FIRE movement…snuffed out?

😨 Why 24% of people are considering cutting 401(k) contributions this year

💰Amercians: ‘Don’t you dare touch my Social Security’

…and SO much more!

The Best Thing I Saw All Week

Remember the heartwarming tale we shared last holiday season about a New York City couple opening their doors to a busload of stranded Korean tourists in a snowstorm?

Well, the story didn’t stop there.

Alexander and Andrea Campagna made good on their promise to visit South Korea with a trip this past week.

But let’s rewind to December 23, 2022.

(That’s when a bus carrying 10 Korean tourists found itself stuck in the snow near Buffalo, New York.)

Determined to keep moving, two of the men from the group began knocking on doors in hopes of borrowing a shovel to dig their way out.

Only one small problem…they weren’t going anywhere.

The snow was too deep – and falling heavier by the hour.

So Alexander and Andrea invited the 10 travelers into their home.

They filled the 3-bedroom house by sleeping on couches, sleeping bags, air mattresses, and a guest bed for a couple of nights.

Fast forward to May 2023, and the Campagnas are now in South Korea.

The couple was invited by the Korea Tourism Organization and has been reunited with their friends.

“To see everyone in Korea again is such a blessing,” Andrea said. “They ended up in the right place at the right time.”

“Now we have people we can call friends for a lifetime.”

Markets 📈

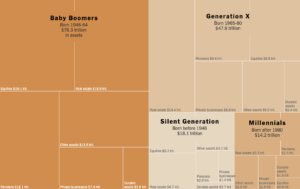

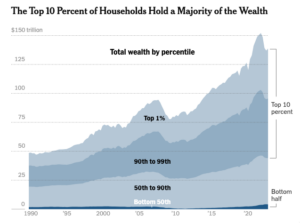

Who’s got the money?

Check out this interesting chart from the NYT, which shows the distribution of wealth across generations and asset classes.

But don’t bother bookmarking it, because it’s all about to change.

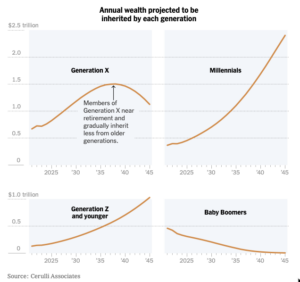

The youngest of the 73 million baby boomers in America are turning 60 this year. (The oldest are almost 80.)

That means roughly $16 trillion will be handed down to millennials and Gen X heirs over the next decade.

But it might happen even faster than that.

The “giving while living” trend is gaining some serious momentum.

This includes property purchases, repeated tax-free cash transfers of estate money, etc.

And it’s all having an impact on the broader market – empowering some and creating even bigger obstacles for others.

Over the next 5-10 years, estate planners and tax planners are expected to be in high-demand as wealthy and upper middle class families think more strategically about wealth transfers.

More Market Reading 📈 |

🔨 Home Depot’s remarkable 14-year run coming to a halt? [Article]

🥇 Investors and Advisors clash on long-term performance of Gold vs. Stocks [Article]

🏡 U.S. home sales fell 3.4% in April + revealing trends [Article]

☀️ Sunlight and Stock Prices: Research uncovers link between weather and trading [Study]

💳 Plastic Surge: How consumers mastered the art of debt accumulation [Report]

Money Mindset 🧠

The FIRE movement – Financial Independence, Retire Early – was all the rage in the 2010s.

Then the pandemic hit, layoffs ensued, inflation followed, and…well…things look a little different.

While the movement is still very much alive, experts say it’s a little chillier than it was 5 years ago.

The idea of retiring at 40 and spending the next 40 years sipping Mai Tais in a poolside cabana are hardly realistic at the moment – even for high earners.

According to financial planners who work with FIRE hopefuls, most have switched their focus from full-on retirement to building just enough savings to create flexible options, like…

▶️ Taking a sabbatical

▶️ Temporarily leaving the workforce to raise kids

▶️ Switching careers

▶️ Moving into part-time work

▶️ Pursuing passion project

The new FIRE mindset is, “I want to accumulate enough savings so that I don’t ever need to save or invest again. Then I can find a rewarding gig that makes me enough to break even on my monthly expenses.”

More Mindset Reading 🧠 |

📉 Annual study reveals 67% of adults expect full-blown recession [Study]

😨 Why 24% of people are considering cutting 401(k) contributions this year [Article]

🤔 Should parents give children debit cards?…Maybe? [Article]

Deep Dive 🔎

Social Security is often called the “third rail” of American politics.

In other words, no politician dares to touch it.

If you do…kiss your career goodbye.

Americans – particularly seniors – are extremely protective of their retirement bennies…

Something that’s as clear in 2023 as it’s ever been.

A new poll finds 78% of American adults are opposed to any proposal raising the full retirement age for SS benefits from 67 to 70.

Opposition holds firm when asked if they would support raising the age if it meant benefits would last longer, with 62% against the move.

Social Security Surplus Evaporates

While SS (as a system) isn’t going anywhere anytime soon, the program’s trustees report the fund’s surplus that’s used to pay out a portion of benefits will run out in 11 years.

Once the surplus is gone, the SS coffers will be 20% shy of where they need to be for full payouts.

Anxiety Taking Root

To understand your clients, you have to understand what keeps them up at night.

And according to this study, anxiety around financial security in retirement is mounting.

Saving for retirement takes the crown as the #1 financial worry for Americans nearing retirement age.

Among respondents aged 50 to 64, 25% expressed concern about building a sufficient retirement nest egg.

Other noteworthy data points:

⭕ 22% say inflation and higher interest rates have them worried about when they’ll be able to retire

⭕ 32% of people between 50-64 years old say they’ve been forced to delay their retirement plans

⭕ 52% say they’d find it either very difficult OR somewhat difficult to come up with $1k in cash for an unexpected expense

⭕ 68% say they’re concerned about whether they’ll have enough money to live comfortably during retirement.

The Bottom Line

What a difference 18 months can make.

Rewind to the end of 2021 and overall confidence in the market was high.

Portfolios were up, home prices were skyrocketing, and inflation hadn’t quite taken off.

But investors are in a totally different headspace in May 2023.

For advisors, it’s not enough to focus on the “hard” side of managing your clients’ portfolios – you have to appeal to the “soft” side too.

If there were ever a time to make an extra phone call to a client, send a quick video message, or offer some words of confidence…

…that time is now.

The best advisors retain clients during times of high anxiety not because they have a crystal ball for Wall Street, but because they can keep their clients grounded with an articulate long-term perspective.

In your corner,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors