“Opportunity is missed by most people because

it’s dressed in overalls and looks like work.”

– Thomas Edison

Hey Sunday Brewers!

Inside this edition:

- The 4-step action plan to boost productivity by up to 40%

- Want to earn more clients? Start with *this* proven approach

- Simple tips to increase your YouTube subscriber count & turn them into great leads

The First Sip

Every week, Sophie-Louise Corrigan lets her 5-year-old daughter, Amina, choose a stranger to perform a random act of kindness for.

The goal? To simply put a smile on their face.

It’s a tradition that started when Sophie-Louise’s was a child.

“Myself and mum used to always do it, whenever we had some money left from the weekly shop or if we really wanted to do it that week, we deducted something from the shop to make sure we had the money, we would always do it,” she recalls.

Now a mother herself, she continues the tradition by letting her daughter go to whoever she’s drawn to and “pick” someone.

“After I’ll ask why she picked them and it is always because she likes something about them either their top or their hair. I always let her pick,” Sophie-Louise says.

The two of them play this little “game” everywhere – even on a recent trip to Turkey.

They’ll buy a stranger flowers, chocolates, or a meal.

The reactions they get make it all worth it.

People will come up and give Amina a high-five or a hug – something she loves.

“There are others who have teared up and said that they’ve had such a horrible week either with bills or a family death and Amina will always say to me that although the person was crying, it was happy tears,” says Sophie-Louise.

“She’s understanding how acts of kindness work and how emotions work.”

1 Caffeinated Neurohack

While most advisors *think* they’re exceptionally talented multitaskers, research shows that just 2.5% are actually able to do it effectively.

That means…and I hate to burst your bubble…your penchant for multitasking is probably harming your productivity.

By one estimate, it hamstrings productivity by as much as 40%.

That’s because the human brain lacks the ability to perform two tasks at once.

So while we think we’re performing multiple tasks at once, we’re really just switching back and forth.

But what if I told you that you could beat biology and effectively multi-task for just $4 to $7 per hour?

The secret: Hire a virtual assistant.

Here’s my suggestion:

- Make a list of the top 3 time consuming tasks that you do each week that technically don’t require your involvement.

- Create a standard operating procedure (SOP) that explains how to do the task.

- Hire an international VA. (Shouldn’t cost more than $4 – $7 per hour.)

- Use your time to focus on the tasks that require your attention.

☕ TL;DR: Use this 4-step action plan to boost productivity by up to 40%

Marketing Psychology Quick Hit

As an advisor, it’s often easy to feel like you’re imposing.

Nobody is rolling down their window at a stoplight and screaming out the window: “I need help saving for retirement!”

And as much as people will put themselves ‘out there’ on social media, you’ll rarely hear people open up and be vulnerable about their financial problems.

But if you just look at the objective data, people want AND need your help.

A study of professionals in the workplace shows that 78% of people believe it’s important and necessary to get support on financial wellness.

(And for all of you doing group benefits, you should know that 61% of employees say they’re more likely to stay at a current job if financial wellness training and resources are offered.)

In other words, you aren’t imposing when you offer to help people.

Silently – behind the facade that says “I’ve got it all together” – people are in challenging financial situations.

For example, most people don’t know that retiring too early could cost them $182,000 in benefits.

(They have NO idea!)

But before you start cold-pitching people in line at Starbucks, make sure you have a smart process in place that helps people where they are.

A new Stanford study recently explored the interventions and messaging that should be used by advisors to help people anticipate future financial challenges and be more proactive in addressing retirement issues before they arise.

While there’s no “silver bullet,” the study suggests a three-phase approach based on its findings:

- Phase 1: Engage and Educate

- Phase 2: Guide

- Phase 3: Enable

Most advisors skip the engage and educate part and go straight to offering guidance.

But if you want to motivate people to plan for retirement (or even just start making smarter financial choices), it starts with engaging and educating.

In other words, it begins with adding value.

This is why I’m such a big proponent of putting yourself out there with lead magnets, guides, webinars, masterclasses, Q&A’s, etc.

Engage with value and you’ll never struggle to find clients.

☕ TL;DR: Want to earn more clients? It starts with *this*

What’s New in SHIFT Nation?

🤭 Margeaux’s bloopers are LIVE! Watch this video for a laugh at what goes on behind shooting a video here at Advisorist… and quick tips to increase your YouTube subscriber count and turn them into great leads!

[ Watch! ]

Weekly Industry Catch-Up

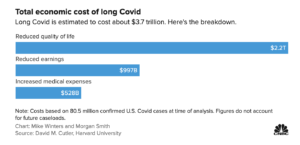

🔹 Covid costs. Experts say “long Covid” could be the next public health disaster, with an estimated $3.7 trillion economic impact. Beyond the medical impact, post-Covid complications are impacting disability benefits, household debt, life insurance, and even retirement savings. Er, excuse us while we isolate ourselves…

🔹 New year, new problems. The warning signs of a potentially serious recession are mounting. From small red flags – like more shoppers opting for “buy now, pay later” holiday gifts – to larger issues like American banks being short more than $1 trillion in capital – 2023 has experts concerned.

What’s on YOUR mind today? Hit reply and let me know!

Take Care,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors