“Resiliency is: Maintaining a balance between strategic action & rest.”

Welcome to The Sunday Brew!

In this week’s email:

- Janet Yellen sounds the alarm, saying the U.S. could run out of cash by June 1

- Breaking down inflation for April 2023 in a single chart

- 48% of Americans are worried about THIS (highest % since 2008)

- Survey shows in-person meetings are back for FAs

- One word has been mentioned 1,072 times on S&P 500 earnings calls this year…and how it’s impacting share prices

And much more!

The Best Thing I Saw All Week

Small things.

Sometimes it’s the smallest acts of kindness that mean the most.

For Mallory Mason, that small act came in the form of a tap on the front door of her Canton, Ohio home.

It couldn’t have happened at a more ordinary moment.

Her young kids were running around the house, the dogs were jumping at the front door, and Mallory was overwhelmed.

The knock at the door was her new neighbor, John, from a couple of houses down the street.

“I’d like to come down and cut your grass, if that’s alright with you,” he said in a warm, fatherly voice.

This was the first time they’d met, but John had heard from some other neighbors that the suddenly-single mother of three was in a bad place.

Her husband had just recently left her and the household chores and responsibilities were piling up.

Mallory – caught off guard by the man’s kindness – felt tears welling up in her eyes as she accepted John’s gesture.

The two shared a heartwarming hug before John walked back over to his garage to get his mower.

“I can’t thank him enough! It’s so nice that people actually care instead of just talking about the storm we are living in,” Mallory wrote when sharing the story online.

“My heart is full. We have so many kind people around us, it makes it a little easier to get through.”

Markets 📈

The Federal Reserve has once again raised the federal funds rate by 0.25%, bringing it to a target range of 5.0% – 5.25%. This marks a 16-year high, reminiscent of the pre-Great Recession era.

Notably, this is the 10th interest rate increase in just over a year. However, indications suggest that JPow’s aggressive tightening cycle may be reaching its conclusion.

As the economy has noticeably cooled down since the rate hikes began, we’re witnessing the emergence of unfavorable side effects in this high-interest environment, including the unfortunate demise of First Republic.

In other news, the latest calculations show Americans have a collective $300B in cash reserves.

While that might sound like a lot, it pales in comparison to the $31.4 trillion debt limit.

Treasury Secretary Janet Yellen sounded the alarm this week, saying the U.S. could run out of cash by June 1. Eesh! 😬

The solution? More debt.

More Market Reading 📈 |

➕ Wholesale prices nudge up just 0.2% in April concerns for many [Article]

📊 Breaking down inflation for April 2023 in a single chart [Article]

🥑 48% say grocery costs now eating up majority of their monthly budget [Article]

📈 Latest NAFA chart contrasts FIA returns YTD to the last 12 months return [Chart]

👎 PacWest Bank stock plunges 30% after losing 9.5% of deposits in one week [Article]

Mindset 🧠

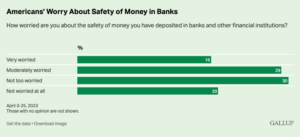

A new poll reveals 48% of Americans are worried about the safety of their money in banks.

The last time fear was this high was during the height of the 2008 financial crisis.

The Gallup study was conducted a month after the collapse of Silicon Valley Bank and Signature Bank, but before news broke about the failure of First Republic.

Interestingly, Republicans (55%) and independents (51%) are more likely to be concerned than Democrats (36%).

(You mean…we can’t even agree on how concerned we are? 😜)

Other interesting findings:

-

54% of adults with no college degree are worried, while just 36% of college grads are concerned about the safety of their money

-

Americans earning less than $100k+ are more worried (50%) than those earning a 6-figure income (40%)

More Mindset Reading 🧠 |

🤓Study says “extreme earners” aren’t necessarily smarter [Article]

🤝Survey shows in-person meetings are back for financial advisors [Article]

💟 Marry for love or money? Psychologists chimes in [Article]

💰 Why $$$ can absolutely buy happiness…under these circumstances [Article]

Deep Dive 🔎

Chalk this one up as interesting…

We’ve heard rumblings of an AI takeover in the world of business and finance for years.

For the past decade, “techies” have projected massive shifts in how we do business.

But up until this year, we haven’t really felt any massive changes.

Until now, that is.

ChatGPT and other tools have risen to prominence over the past 5 months and it’s no longer able to be ignored.

Bloomberg reports that AI has been mentioned 1,072 times on S&P 500 earnings calls this year.

And there’s a good reason for it…

Companies that have embraced generative AI this year have earned shareholders 0.4% more per day than those with less tech exposure.

The best example is Microsoft, whose stock has enjoyed a major boost after making a massive AI bet on ChatGPT-maker Open AI with a $10 billion investment in January.

Its stock price has boomed by 28%.

If you think AI is just a fad or overblown trend, just pay attention to the money trail of big companies.

Google just launched a beta search feature that uses generative AI to provide more information and better context inside the search engine.

IBM’s CEO has gone on record saying its new AI tools will be able to automate 30% to 50% of “repetitive” office work.

But for as useful as AI is with certain tasks, it’s still not ready to replace humans.

As the ongoing writer’s strike shows, AI isn’t quite a worthy substitute for late-night hosts in need of comedic monologues.

Enjoy your Sunday,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors