“It’s not about ideas. It’s about making ideas happen.”

– Scott Belsky

In this week’s email:

- New legislation set to help advisors with <$100M AUM

- The real reasons WHY Americans don’t do estate planning

- Never-before-seen ‘cash trend’ has economists puzzled

…and that’s just the start!

Scroll down and take a sip ☕

The Best Thing I Saw All Week

John Stessel normally performs his 🔥 magic shows in front of A-list celebs and other fans.

But he recently found another, er, equally enthusiastic… audience.

Stressel now regularly performs for dogs at a local pet shelter in New Jersey. 🐶

He records the performances and puts the videos out on social media.

But these aren’t cringeworthy “look at me” posts.

John does it because the dog’s adorable reactions help get them adopted. 😊

Reactions, you might be asking? 🤔

Yeah…it’s actually really cool.

You see, dogs are smart cookies…

And when John makes their treats and toys poof into thin air, they’re left flabbergasted. 🤣

“One of my small little superpowers is I can just help dogs show off in a way that they couldn’t without me,” Stessel says.

“Typically in the video the dogs just go nuts and they all have really different reactions.”

Despite being allergic to dogs – and regularly taking 4-5 antihistamines on set – he keeps doing it.

As a result, nearly every dog in his videos ends up finding a forever family 😍

Industry Roundup 📈

New legislation aimed at easing the regulatory burden on small financial advisory firms is gaining momentum.

The U.S. House of Representatives passed a bi-partisan bill (367-to-8) in favor of the Small Entity Update Act.

It will now go to the Senate.

If passed into law, the legislation would direct the SEC to assess regulatory costs of compliance for small and growing businesses, ensuring that rules placed on these businesses are not overly burdensome.

This means smaller firms – those with $25M to $100M in AUM who aren’t typically registered with the SEC – will face less pressure when it comes to the paperwork, research, and red tape of complying with regulations.

Chalk this one up as a win for the ‘good guys!’

More Market Reading 📈 |

💰 45 million borrowers are now back on the hook for their student loans

🏛️ ‘Accredited investor’ law could give advisors access to private markets

📈 How the new debt ceiling will impact your clients’ wallets

🗣️ Maggiulli: This ‘Down & Sideways’ market is more bullish than normal

🏡 Housing market has some considering a $43K Home Depot house kit instead

Where There’s a Will… 📝

Nobody likes talking about death.

Perhaps that’s why only 1-in-3 Americans has a will.

And the statistics are even grimmer for people of color.

Just 23% of Black and 28% of Hispanic respondents have a will.

Why the estate plan dodge?

Procrastination topped the list at 43%. Other reasons:

👉 Insufficient assets (25%)

👉 Not knowing how to create a will (20%)

👉 Wanting ‘next of kin’ to receive everything (9%)

👉 Feeling too young for a will (23%)

👉 Not wanting to think about death (12%)

As you can see, wealth and education disparities, coupled with the misconception that estate planning is an upper-crust affair, hits people of color hard.

“Access to law is a real issue,” says Jenny Xia Spradling, CEO of an estate planning platform. “It’s pricey and often seen as pricier than it is.”

People don’t want to think about it AND they think it’s more expensive than it actually is.

For advisors who offer estate planning services – either in-house or in partnership with someone else – these are the hurdles that must be overcome.

Potential solutions include transparent pricing for estate planning services (don’t hide the price!) and more convenient/speedy processes for getting a will done.

What Else We’re Reading 🧠 |

⛔ Advisors are speaking out against SEC’s custody rule proposal

💰 Debt-Ceiling Deal Will Cost the IRS Up to $21.4 Billion

⬇️ The U.S. jobs that will shrink the most over the next 10 years

👓 Will Apple’s new ‘Vision Pro’ be bigger than the iPhone?

👎 Hustle Culture vs. Quiet Quitting: Why both are a big FAIL

Deep Dive 🔎

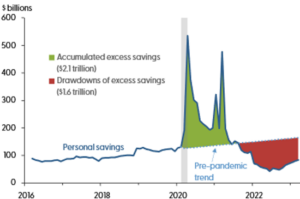

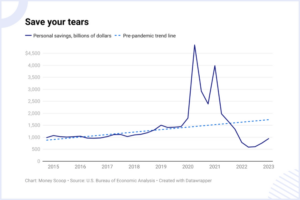

Picture this: A trend line showing US household savings from 2015 to 2019.

‘The Little Line That Could’ is bopping along into the 2020s without a care in the world.

Then, bang! The pandemic.

Suddenly, that tidy little trend line is about as relevant as a Blockbuster membership card.

From March 2020 onward, the actual savings line looks more like a non-compliant Disney World roller coaster.

The first round of stimulus checks sent savings soaring…albeit very briefly.

Then things plummeted…until the next stimmy hit the checking account.

And it’s been mostly down ever since.

By the looks of the chart, most Americans have already burnt through their lockdown loot and are actually in a worse position than they were pre-pandemic.

In Q1 of 2023, savings drawdowns averaged $85 billion per month.

Cumulative drawdowns are at $1.6 trillion as of March 2023 (that’s the red area).

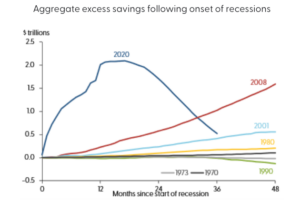

At first glance, that seems pretty normal, right?

Some decline is normal following the onset of a recession…

…or is it?

Economists warn that this is unlike anything we’ve ever seen, as depicted in this chart:

There’s a lot more slope in this trend line than in the past ones.

While there’s still a lot of cash ‘out there,’ it’s disproportionately held in the vaults of top earners.

What does all of this mean for the long-term?

If I could give you a concrete answer, I’d probably have a Nobel Prize in economics sitting on my desk.

Economists aren’t quite sure what to make of it (since this trend line has never been seen before).

But here’s what I will say to you as an advisor who touches people’s money…

All this see-sawing back and forth over the past 3 years has people anxious.

Whether middle class, wealthy, or one-percenter, there isn’t a household in your target market that hasn’t gotten a little financially nauseous at some point over the past 40 months.

It’s not your job to save people.

It is your job to be a voice of reason who brings a pragmatic plan to the table that people can cling to like a life preserver in the middle of a stormy ocean.

If you aren’t 100% clear on what you’re bringing to the table, you’re going to have a hard time acquiring new clients.

Lead generation and prospecting matter, but only once you know what you’re selling.

Take some time to think about your offer this week.

In your corner,

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors