Want a quick filter you can use to analyze whether you’re spending your time on the right strategies and techniques to grow your financial or insurance practice?

This is the rule of thumb that I always follow:

Look for the highest ROI for the least amount of work AND the lowest learning curve.

And though it might sound impossible to get all of that in one package, it’s a lot more practical than you think.

Read on to discover how LinkedIn profile optimization could be the secret variable to a successful financial services and life insurance prospecting strategy in 2021 and beyond.

LinkedIn: The Untapped Gold Mine Virtual Financial & Insurance Advisors are Missing

If you’ve been a part of SHIFT Nation for any amount of time, then you know we LOVE email marketing, webinars, Facebook advertising – all of it!

But if there’s one thing we have a deep PASSION for, it’s LinkedIn.

The reason is two-fold.

For starters, the highest net worth prospects are on LinkedIn. (Better than Facebook, Instagram, Twitter, etc.)

Here’s the curated research:

- Active LinkedIn users own more investment products on average (5.6) than social media users who don’t use LinkedIn (5.0) and non-social media users (4.8).

- 2 of 3 investors with investable assets exceeding $100k are active on LinkedIn.

- LinkedIn attracts investors with higher affluence, including 60% of those with $1M to $5M, and 37% of those with $5M+ in investable assets.

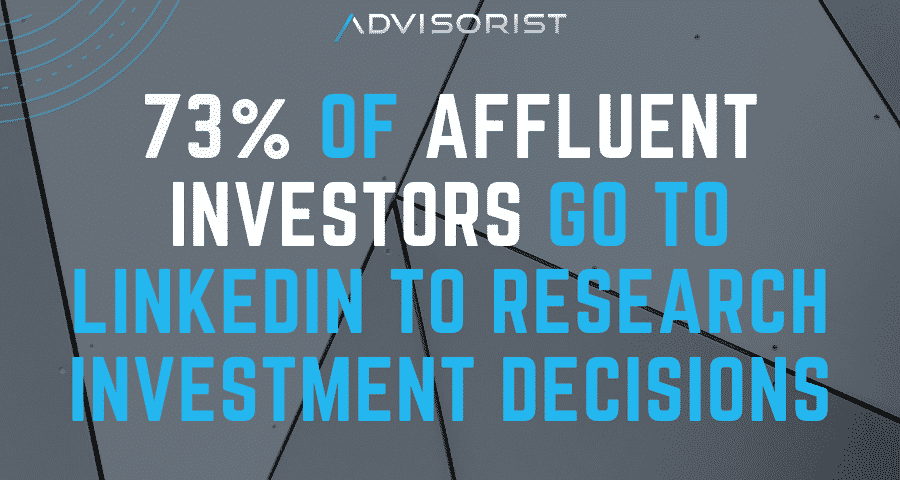

- 73% of affluent investors go to LinkedIn to research investment decisions…more than all of the other social media platforms COMBINED!

- Advisors who prospect on LinkedIn achieve a 62% success rate. Of those, 32% pick up $1M+ in new AUM.

The second reason we love LinkedIn is that it’s RIPE for the picking.

While there are tons of affluent prospects looking for help on LinkedIn, there are very few insurance and financial advisors actually there to meet them and add value.

There’s a massive gap in the market.

And if you’re smart about it, YOU can be the advisor that bridges this divide.

But you have to know how to leverage the platform. And that starts with strategic LinkedIn profile optimization.

31 LinkedIn Profile Optimization Tips for Virtual Advisors

Your LinkedIn profile is your virtual first impression.

If you have a strong, clean profile that clearly articulates why YOU are the person that your prospects should trust to help them make financial decisions, you’re going to generate more leads than you know what to do with.

The problem is that most financial and insurance advisors don’t have very good profiles. (And that might include you!)

But no worries…we’re going to get you all straightened out.

Here are some tips you can put into action right away:

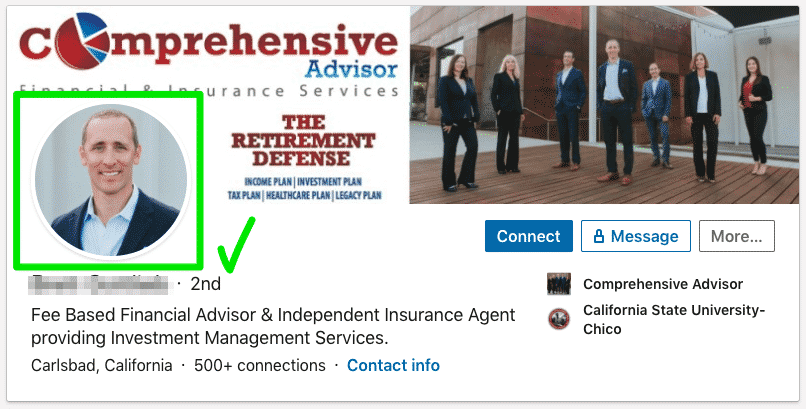

LinkedIn Banner Tips for Insurance & Financial Advisors

Your LinkedIn banner is VALUABLE real estate. It needs to be used properly. This means knowing what to DO, as well as what NOT to do.

1. DO use a quote, slogan, or statistic that your target can resonate with.

2. DO use your logo in your banner to establish a connection between you and your brand.

3. DO use contact info (if you want people to contact you directly).

4. DO think of your banner as your “Virtual Billboard.”

5. DO use evocative imagery that shows people who have already realized the prospect’s deepest desire. It engages who they want to be.

6. DO ask yourself: Where does the client want to go? Where do they want to be? Pick header images that align with this.

7. DO use a website like Pexels to find high-quality royalty-free images that don’t cost a dime.

8. DO study Fisher Investment advertisements. (They test hundreds of combinations. When you see something Fisher is using, rest assured it’s working in the financial and insurance advisory space.)

9. DON’T use a plain or generic image (stock photo of a city, nature, cheesy actors, etc.)

10. DON’T use your logo with nothing else. (Nobody cares about your logo. They care about how you’re going to make them feel!)

11. DON’T use the generic/default banner setting. People will think you (a) don’t care, and/or (b) aren’t sophisticated enough to learn the platform. (So why should they trust you to manage their money, help them with insurance etc.?)

LinkedIn Photo Tips for Insurance & Financial Advisors

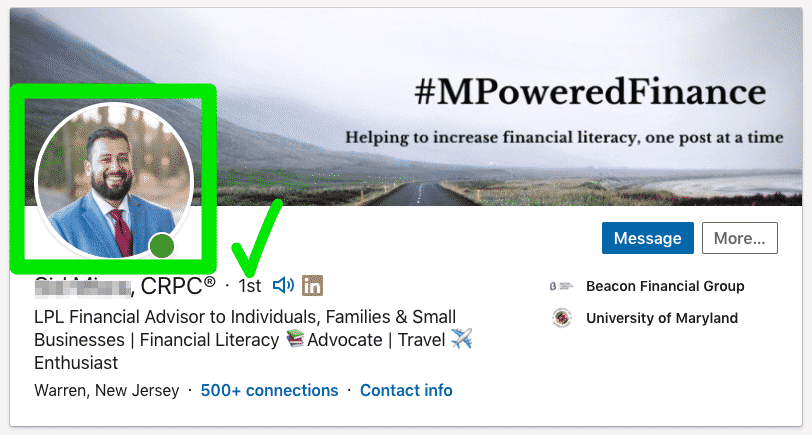

Your LinkedIn profile picture is one of the few things that prospects will see before actually clicking on your profile. This makes it THE first impression setter.

Here are some LinkedIn photo tips:

12. One of the biggest disruptors is when your headshot doesn’t look like you. If you don’t match up with your headshot it creates inconsistency. People wonder, what else are you not telling me? Use a profile picture that’s been taken within the last 12 months and update it regularly.

12. Headshot should be majority head – upper shoulders are fine, too.

14. Head slightly tilted to the side is good.

15. Ensure you have clear / high resolution. If your camera isn’t capable, hire a professional photographer for a 30-minute photo shoot.

16. Use a neutral background to eliminate distractions.

17. Use a website like PhotoFeeler.com to get feedback on your profile picture and what it says about you.

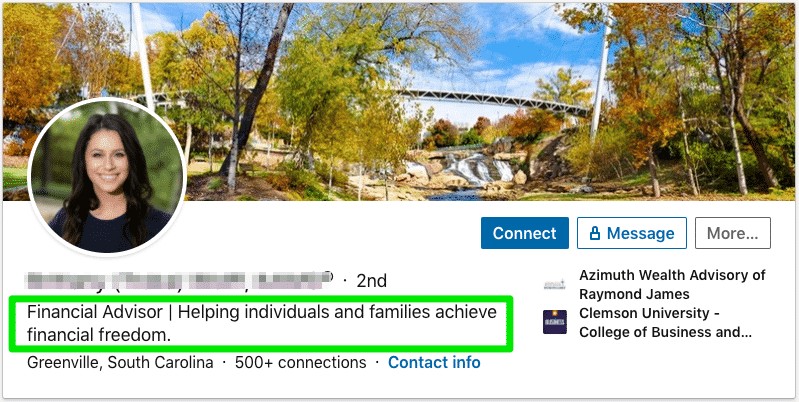

LinkedIn Tagline Tips for Insurance & Financial Advisors

Boring taglines are a quick turnoff. Nobody cares what you “do.” They want to know how you’re going to add value to their life/money/etc. We recommend insurance and financial advisors useUse the following tips to craft a compelling LinkedIn taglines:

18. Use strong impactful words that get across what you do, who you work with, and the problem you solve.

19. “Help” and “helping” are great words to use.

20. Remember that people don’t want to be sold, they want to be helped.

Other LinkedIn Profile Optimization Tips for Insurance & Financial Advisors

Looking for more quick and juicy techniques you can put into play right away? We’ve got plenty more where those just came from:

21. Try this hack to maximize real estate at the top of your profile: In the First Name Field: Put your full name. In the Last Name Field: Put your title. In the Headline: Put your USP.

22. When crafting your USP, be sure to convey authority and explain concisely the problem that you solve for your clients. You want to be seen as the person who has the answers they need.

23. Research in neuroscience shows that when you put a numeral in a phrase, the brain stops and reads it. Use numbers to get people to zero in on your banner, title, USP, etc.

24. People don’t want to search for anything. Make info easy to find. Include your phone number in the title portion.

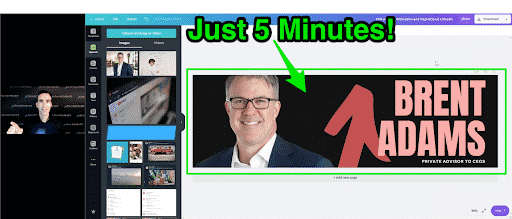

25. Use Canva as a free/inexpensive DIY design solution.

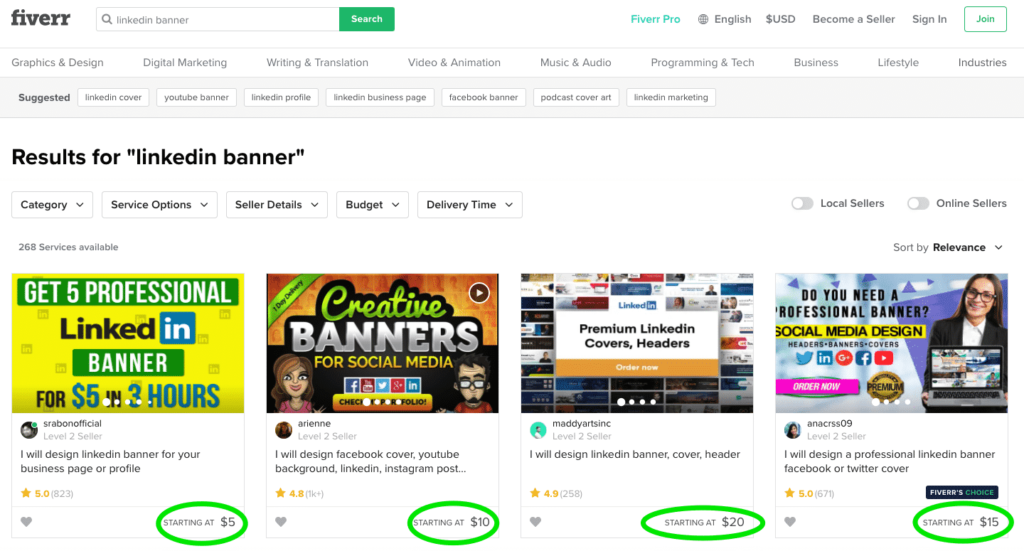

26. Want to be totally hands-off with designs? Use Fiverr as a cheap and quick done-for-you solution.

27. If you’re thinking about making a change to your profile, put those changes up on social media and ask for feedback. This is a good way to connect with people in an honest and humble way. At the very least, you’ll get some good feedback. But it’s also possible that you’ll pique the interest of a prospect or two.

28. Getting the right niche is key. Research LinkedIn groups to find ideas for specific niches within niches. (Example: Don’t just go after veterans – narrow your focus to Navy veterans. Or go one step further and brand yourself as someone who specializes in working with Navy veterans who are women.)

29. Emphasize quality connections over quantity. When you use spammy methods, you need thousands of connections to generate results. But when you niche down, you need FAR fewer connections. It’s about efficiency!

30. Focus on the long game – not quick sales. You’re building relationships. Be okay with the “sale” not coming for several months (or even years). Invest in people, add value, and nurture. The results will eventually follow.

31. Consider hiring a Virtual Assistant to take some of the time-consuming, administrative tasks off your plate. (You can get many hours of work from a VA for just $50 to $75 a week.)

Done is better than perfect.

Progress – not perfection – is the goal.

Implement at least 10 of the tips discussed in this post TODAY.

Then implement another 10 tomorrow.

Get to work!

Grab Your Seat for the Largest Gathering of Financial Advisors in 2021

If you were one of the 6,110 insurance or financial advisors (representing $194.88 BILLION in AUM) who attended the inaugural Virtual Financial Advisor at the start of the pandemic in May 2020, then you got a SMALL taste of what this year’s event is going to be like.

The (2nd Annual) Virtual Financial Advisor Summit 2021: NEXT is going to be groundbreaking.

Prior to the pandemic, just 2% of insurance and financial advisor meetings took place online.

Today, 98% are happening on platforms like Zoom.

Are you MAXING out the value of platforms like Zoom and LinkedIn?

We have 15 TOP financial advisors and coaches already lined up to share the secrets they’re deploying to get new clients virtually, RIGHT NOW, without spending a dime on ads or meeting anyone in person.

And we’re adding new names weekly. (Including best-selling authors, world-class speakers, and folks from Facebook, J.D. Power, Money.com, etc.)

Want More Growth Tactics for Scaling Your Insurance or Financial Advisory Practice…100% Virtually?

Want more timely and practical strategies like the ones you learned in this LinkedIn profile optimization guide for virtual advisors?

We’d love to have you join us every Wednesday at our brand NEW time 12pm ET / 9am PT when I teach insurance and financial advisors how to build automated appointment engines that HUM to the tune of $50,000 monthly (or more).

You’ll learn from the top experts and front line marketing experiments that have generated 61,429,096 leads and $312,493,381 in revenue ALL in insurance and financial services over 15 years.

Best of all…it’s totally FREE.

But there are no replays. So please show up live and ready to take notes.

You can click here to add the Virtual Advisor Power Hour to your calendar!