Can I be frank with you all?

We – meaning our industry – are doing a really bad job of representing ourselves and it’s not helping us create sales, establish preeminence, or convert prospects into clients.

I see this in many facets of digital marketing, sales, and networking, but it’s especially common in virtual meetings.

I see insurance and financial advisors coming in unprepared, putting forth sloppy presentations in virtual meetings, and really not giving any forethought to the details.

And that’s unfortunate, because trust and communication are key ingredients in the success equation for virtual advisors.

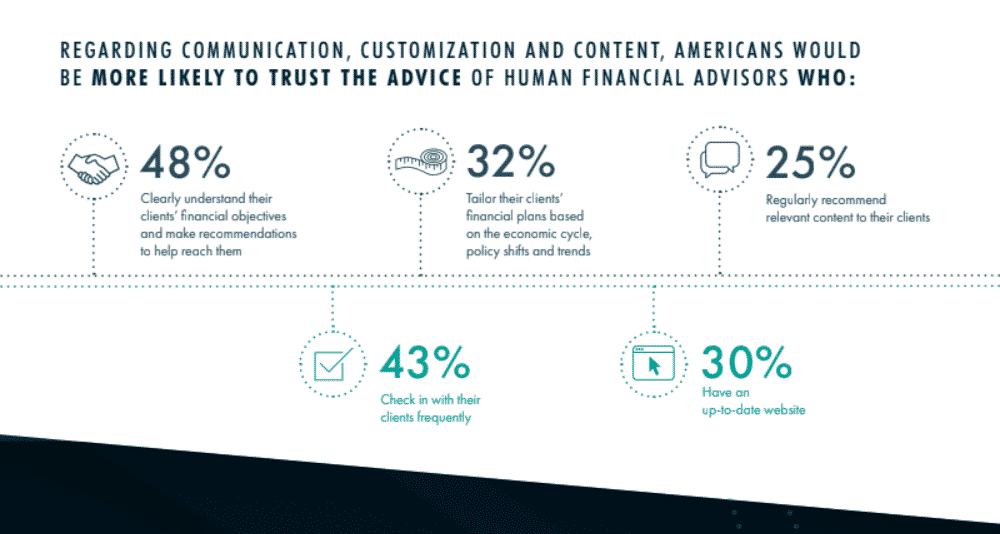

In a recent study, Million Dollar Round Table (MDRT) found that prospects and clients are far more likely to trust the advice of an advisor who is organized, communicative, and puts forth a strong online image.

Yet in spite of this, many advisors have MISSED the mark over the past six months.

According to a Fidelity study on The Impact of the COVID-19 Pandemic on Engagement, just 42% of advisors with fewer than 150 clients have reached out to every one of their clients during the crisis.

That number shrinks to 18% for advisors with more than 300 clients.

And here’s the kicker…

8 of 10 advisors who DID continue to engage and prospect are reporting average or above average results through the pandemic.

If you haven’t reached out to every one of your clients, you’re messing up.

I don’t know how else to sugarcoat that.

You need to be in touch with every single one of your clients to show them that you support them and that their money is in good hands.

And these touchpoints need to be representative of the value you’re offering.

Stop with the sloppy meetings and disorganized calls.

We need to get it together.

And in this article, I’m going to walk you through some of the virtual meeting best practices you can use to WIN – particularly when it comes to the technology behind these meetings.

Virtual Meeting Best Practices for Technology

Knowing, having, and using the right technology is one of the biggest factors that holds advisors back from being successful with virtual meetings.

If you can arm yourself with the right tech tools, you’ll be in a better position than 95% of other advisors.

Thankfully, I have a strong pulse on what’s happening in this space.

Why?

Because I host virtual meetings, webinars, presentations, trainings, and workshops every single day.

So I’m not giving you hyperbole or some roundup of what others are saying.

I’m going to show you 100% what’s working in the industry RIGHT NOW.

These are the tools and tactics that are working on the front lines for insurance and financial advisors TODAY.

And I want you to leverage them to enhance your image, establish preeminence, and stoke the flames of engagement.

Let’s take a look:

1. Virtual Conferencing Technology

There are three common options advisors turn to for virtual meeting software. Here’s a breakdown of why each stands out:

GoToMeeting (Best for advisors who want something simple yet reliable.)

- Simple way to get your basic tech stack

- Good support

- Minimal friction with onboarding attendees (most already have it installed on their computers)

- User interface isn’t as great as some others, but it’s usable.

Zoom (Best for advisors who need a few advanced features.)

- Used to have tech issues with security, but that’s no longer an issue. They have dramatically redeveloped their security. It’s very tight and on point.

- Almost everyone is familiar with it at this point – making it a trusted solution.

- Attendees can access it straight from the web – no download required.

- Greater user interface and more advanced features.

- Record feature (part of the upgraded package) automatically saves meetings to the cloud.

- The Breakout Rooms feature is really useful for splitting people up into groups to collaborate or network.

- Best option if you’re working with people who aren’t good with tech. Very simple and straightforward.

ZoHo Meetings (Best fit for advisors who are on a budget.)

- Very inexpensive option if you’re on a tight budget.

- Lots of neat integrations and features (including calendars, recording features, email reminders, etc.)

- Biggest con is the lack of customer support and the limitations on event attendees (250 max with the top tier plans).

- Okay for client meetings and small events, but not your best option for larger webinars.

2. Scheduling

Calendly is by far the best option for most advisors.

It has a great interface, integrates with almost anything you want it to, and has pretty decent support.

I’d recommend beginning with this option.

In full disclosure, my team and I have transitioned over to Acuity Scheduling. It’s a little more challenging to set up, but is great for advanced needs. We have it fully integrated across our tech stack and love it.

If you have more advanced needs, Acuity is another option to at least consider.

Regardless, all of the virtual meeting tools are starting to integrate with each other – which is great news for advisors.

You can now fully integrate scheduling with your virtual meeting platform and calendar to save time, reduce stress, and mitigate confusion.

But rather than just send people a calendar link and tell them to book a time, give them multiple options.

This lets you game the system, so to speak.

You can create and architect different meeting types that create authority and preeminence. So rather than just offer standard 30- or 60-minute timeblocks, you create meeting options.

This allows you to control the feeling around the meeting and increase the likelihood that people schedule one.

I find that these options are working well in today’s climate:

- 15 Minute Virtual Coffee (People don’t want to “meet” – they want to have chit-chats.)

- 60 Minute Meeting

- VIPs & Friends

- Clients Only

Do you see how these sound better than just asking people to book a cookie-cutter meeting?

3. Cloud Storage Solutions

Instead of storing everything on your laptop where it can be stolen, choose a safe cloud solution.

Google Drive has great integrations which is why I like it more than DropBox. (But either works.)

As your team grows, you’ll see how much easier it is to share files and communication with others.

4. E-Signature Platforms

While there are some companies that still require wet signatures, most of the industry has come around to the idea of digital or electronic signatures by now.

And there’s really one market leader: DocuSign.

It’s easy to use, people are comfortable with using it, and it checks all of the legal boxes.

If you don’t like DocuSign for some reason, give SignEasy a shot.

5. Backdrop

To make the most out of the Zoom virtual background feature, you’ll want to buy a green screen.

It’ll give you much better quality and eliminates most of the annoying glitches and distortion that occurs when you have an unpredictable backdrop behind you.

You can get a simple green screen from Amazon for as little as $25.

There are a myriad of options – so do your research and look for the right style at a price point you’re comfortable with.

Options include:

- Collapsable & retractable green screens

- Full green screen setup with frame

- Green screen fabric/sheet (can be affixed to your wall)

- Portable (attaches to the back of your office chair)

6. Set a Three-Step Agenda

This isn’t really a tech tip, but it’s certainly one of the top virtual meeting best practices – so I’m going to throw it in here at the end.

In addition to securing the right technology, you also need to send each prospect or client an agenda prior to the meeting.

This can be integrated into your scheduling process

You don’t need anything fancy, but it should be specific.

Keep it to three points and let the prospect/client know what to expect out of the meeting.

For example:

- Personal Check-In

- Markets & Portfolio Check

- Action Steps

Having an agenda like this sends a signal to the client that you’re prepared and serious. They feel like their time is being valued.

And as we discussed at the beginning of the article – that’s half the battle.

Grab Your FREE Virtual Meeting Playbook

We’ve only skimmed the surface in this blog post.

If you want to WIN big with virtual meetings, you need to understand everything from securing appointments to engaging clients and prospects to following up afterwards.

Thankfully, we have a brand new playbook that goes in depth on all of these topics and more.

It was developed in the middle of the COVID-19 crisis as a response to the issues that insurance financial advisors are facing RIGHT NOW.

And I believe it will be a powerful resource for you.

Let us know that you want a copy and we’ll send you The Definitive Virtual Meeting Playbook for Insurance & Financial Advisors: 44 Proven Tips, Tools, and Secrets From the Front Lines….

…at NO COST to you.

Armed with these insights, I believe you’ll shatter some of the barriers that have so often suppressed advisors in our space from winning in the virtual environment.

Are You Attending My Weekly Masterclass?

Each Wednesday afternoon at 12 noon ET, I host a weekly masterclass that’s designed specifically for the industry’s top insurance and financial advisors.

Hundreds show up ready to play full out.

We deliver massive value. Spark thought-provoking conversations. And celebrate wins.

Most importantly, we arm ourselves with the tools we need to CONQUER the week ahead.

It’s totally free.

(Yes…100% GRATIS.)

Over the next few weeks, these Virtual Advisor Power Hours will be laser-focused on the subject of virtual meetings…

Building on the techniques and tips discussed in this blog post.

And I want YOU to be there.

All you have to do is show up and I PROMISE to deliver the goods.

Click the link below to add it to your calendar

4 Responses

This information comes from decades of experience from one of the most successful marketers in the financial and insurance industry…and he gives it away for FREE. 😮

That’s right, Rob!

We appreciate your support. You’re always playing full-out!

-Sky (Team Advisorist)

Tremendous, action-packed with down-to-earth working Information. THANK YOU!

Taking advantage of all the GREAT information provided! Looking forward to the RESULTS!