LinkedIn is an absolute gold mine for lead generation in the financial and insurance industries.

As an advisor, you need to know that 79% of ultra affluent investors are researching their options online, and they trust content they find on LinkedIn 159% more than what they find elsewhere.

But that’s also good news for you if you’re looking to create strategic partnerships within the industry.

If the consumer is on LinkedIn, so are the service providers – at least the savvy ones you want to be partnering with.

So if you’re looking for CPAs to build partnerships with and create some back-end cash flow, you need to be building a LinkedIn profile that works like a marketing asset, not just a social media account.

Here’s how you can set up your profile to become a magnet for CPAs, other strategic partnership clients, and advisory clients.

Step One: Write a Professional Headline That Speaks Directly To Your Prospects

A lot of people go wrong on LinkedIn because they write it like they would a resume – they try to find the most impressive titles to include and write out their experience like they’re job hunting.

All you’re going to do is get approached by headhunters looking to hire you under someone else if that’s how you approach your profile.

To use LinkedIn like a business owner, not an employee for hire, your professional headline needs to be about your prospects – primarily what you can do for them and why they want it.

Call out your ideal clients directly by starting with who you help, and then give a brief overview of how, in a way that feels conversational.

Be value-focused.

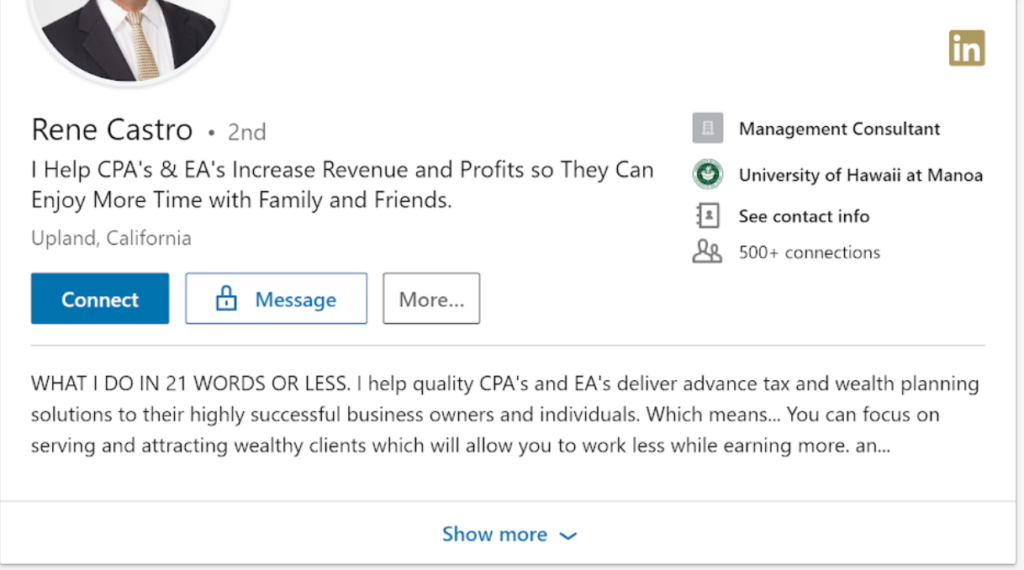

Here’s a great example from an Advisorist member who asked for a profile critique recently:

“I help CPA’s and EA’s Increase Revenue and Profits! Maximize Your Wealth While Working Less!”

See how he immediately cuts to the chase of who he helps, what he helps them with, and the emotional “why” behind his client’s desire to achieve these results?

That’s how you nail a professional headline on LinkedIn.

[Related Reading: How To Make More Positive Associations With Prospects]

Step Two: Qualify Prospects With Your Summary Preview

The key to the summary is recognizing that while you can and absolutely should have some great content in there, your first 21 or so words need to bring it home because that’s how much of a preview the casual browser gets when looking at a profile.

If you don’t snag their attention in the first 21 words, your prospect is just going to leave the page, regardless of how much great content you’ve got hidden under the “Show More” jump.

In this “preview window” of your summary, you should aim to qualify any prospects who are reading, in order to reduce the number of unqualified prospects gumming up your messages. Then you want to speak to the benefits that qualified prospects are looking for and aiming to achieve – not what you do for them or the nitty-gritty details.

Again, your profile as a business owner on LinkedIn is all about speaking directly to your prospects and attracting your ideal clients – it’s not about collecting your work experiences and titles.

After your “21 words or less” summary, you’re ready to get into more details, more benefits and features, and more qualifying.

Here’s an example from the profile we shared earlier:

“I help quality CPA’s and EA’s deliver advance tax and wealth planning solutions to their highly successful business owners and individuals. Which means…”

Notice that he calls out “quality” CPA’s and EA’s, so that he only speaks to fellow business owners who identify with quality services and have that confidence.

Then he specifies, “to their highly successful business owners and individuals”, which speaks directly to the goals of the ideal client.

That’s the type of summary preview, and overall tone of summary, you should be looking to write.

Step Three: Handle Objections In The Summary Body

While this is technically still part of your summary, it’s important enough to merit its own step.

Most business owners stop after the summary.

They’ll call out their ideal client, qualify, talk features and benefits, and then call to action.

But if you really want to ensure you’re speaking to the best possible prospects and minimizing the active selling you’ll need to do, you should add some objection handling into your summary.

Think of your top 1 or 2 most common or biggest objections, and then address them.

You can do this with some humor, and inject a level of empathy into it.

In our example profile, our member writes,

“I know what you’re thinking… Well, my office is not near you. Can this process still work for me? How about this answer? ABSOLUTELY! Through conference calls and shared screens.”

Don’t be afraid to embrace your individual personality.

Always remember: People buy from people.

Step Four: Provide Social Proof

While not entirely necessary, this is where you start to separate the good profiles from the greats.

Add a list of projects you’ve worked on (briefly), and results you were able to achieve. If you have testimonials who have agreed to share their names, this is a great place to share a few of them in abbreviated forms.

It saves your reader needing to scroll all the way down to the bottom of your profile, or click through to a new page, to see how awesome your clients think you are.

If you can format these like case studies, even better!

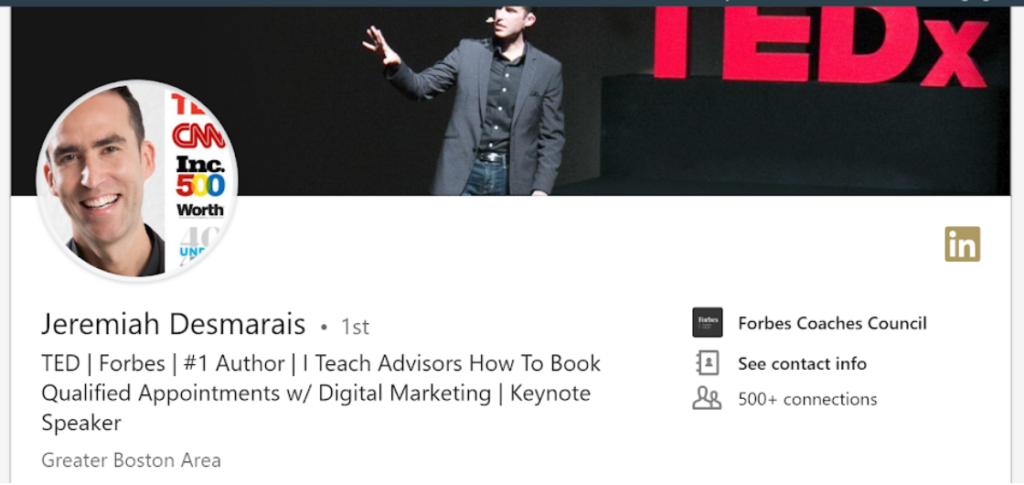

Another simple way to do this is to add the logos of companies and brands you’ve worked with or been recognized by in your headline or profile picture – for some extra oomph.

Step Five: Include Lead Magnets and Freebies

Not a lot of people take advantage of the file linking capabilities LinkedIn has added recently, but we suggest you do.

Add a few video case studies or pdfs, or include any of the lead magnets you might be using currently to generate more interest, provide more social proof, and demonstrate your expertise.

This is like the icing on the cake for a completely optimized and effective LinkedIn profile.

[Related Reading: How To Build A Personal Brand When You’re A Financial Advisor On A Budget… For About 5 Bucks]

Step Six: Always Have A Strong Call To Action

Just like with any marketing asset, and that’s what your LinkedIn profile has now become, make sure you give your prospects the next steps and direct them on where they should go to learn more.

Absolutely invite readers to reach out by including a phone number or email they can write.

You can also try a calendar meeting link they can click through to schedule a video discovery call with you at their most convenient availability.

We like Calendly and TimeTrade.

This will save you a ton of time and headaches you’d normally waste on the endless back-and-forth trying to find a day and time that works for both parties.

If you have a website you’ve optimized for conversions, you can also send your prospects there.

And if you maintain an email list, you can send them to the opt-in page.

The 6 Steps To A High Converting LinkedIn Profile

Here’s your abbreviated checklist for crafting the highest converting LinkedIn Profile you can:

- Use your professional headline to speak directly to your ideal clients, by calling out who you help and how in a single liner.

- Use your brief summary preview window (approx. 21 words) to qualify prospects by getting into more detail with who you help and what you help them achieve.

- Use your summary body to handle your biggest and most common objections, which helps further qualify prospects and saves you valuable time on a discovery call.

- Don’t forget to use social proof to help your prospects understand what you do and connect with the results you can give them.

- Include videos and downloadable freebies or lead magnets to demonstrate expertise and generate more interest.

- Include your call to action and provide a way for prospects to contact you that is as simple and hassle-free as possible. If you’re comfortable with it, including your cell number makes people feel that you are dedicated to helping them and are more trustworthy, because you’re openly sharing more personal information and connecting on a more personal level.

Now get out there and start converting the clients of your dreams!

You’ve got this.

And if you’re looking for some more help, opt into our free newsletter full of tips, tricks and insights, loved by more than 24,730 financial advisors, insurance agents and titans of industry for more great content, tips, and tricks directly in your inbox twice a week.

One Response

What if with your advisory business you want to attract end consumers and COI like CPAs? Should you set up two “business” LI profiles and use those and somehow combine your message to appeal to consumers and CPAs?