The human brain may be the most fascinating organism in the entire universe.

It’s the only organ in the world that has a conscious understanding of its own existence.

And as MRI technology has improved over the past couple of decades, it’s now possible for researchers to study different areas of the brain and their response to various stimuli.

When a person is learning something new, researchers can track the parts of the brain that light up.

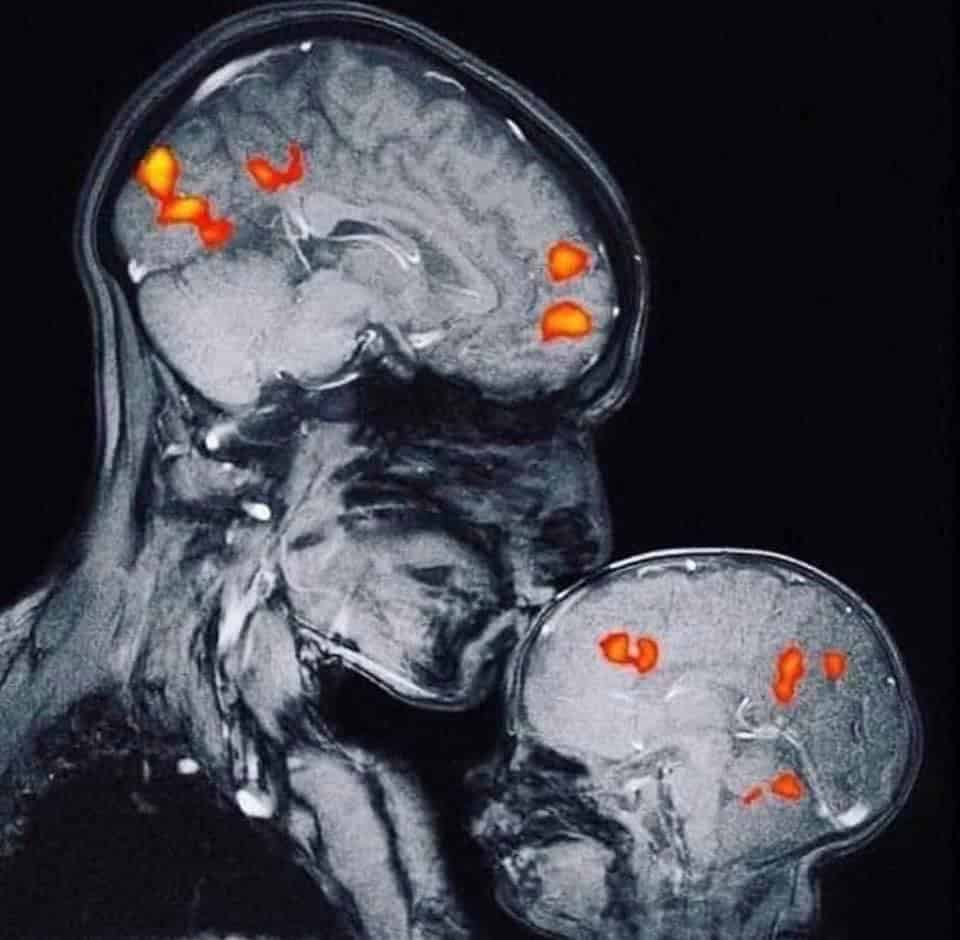

When a mother kisses her baby, you can see the chemical change that occurs in both the mother and the baby.

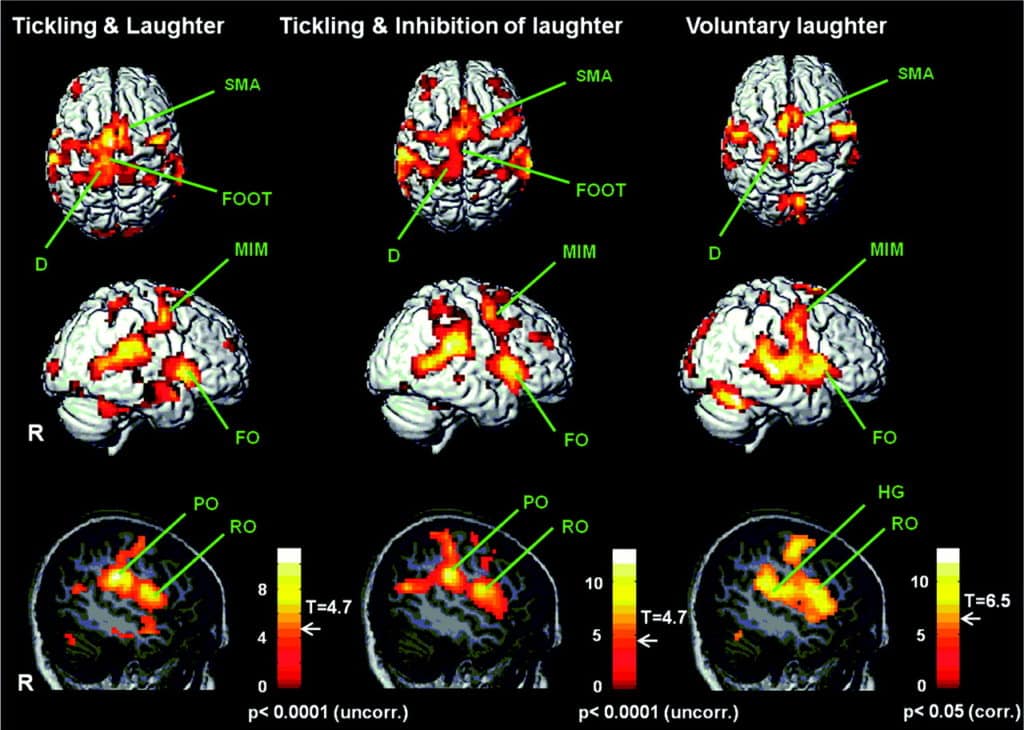

It’s even possible to see how different types of laughter – including laughter from tickling and voluntary laughter when you find something funny – ignites various parts of the brain.

But out of all the different types of stimuli humans are exposed to – including substances, love, laughter, exercise, education, and entertainment – nothing LIGHTS UP the brain quite like imagination.

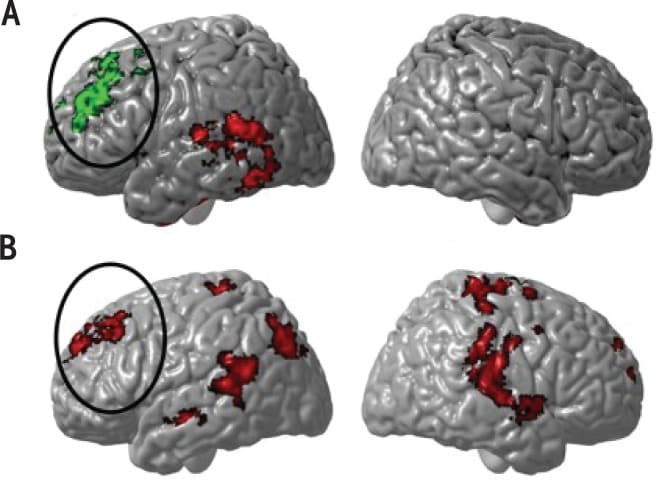

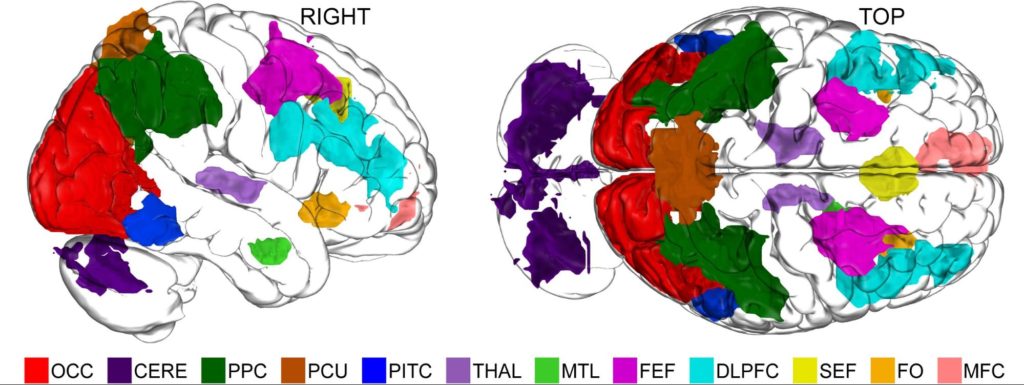

According to a Dartmouth study using functional MRI to measure how humans are able to manipulate mental imagery, 11 areas of the brain show differential activity levels during imagination.

Not one, not two, not five…ELEVEN!

That’s practically the entire brain.

It looks like this:

Amazing, right?

As the study concludes, “Imagination lies in a widespread neural network — the brain’s ‘mental workspace’ — that consciously manipulates images, symbols, ideas and theories and gives humans the laser-like mental focus needed to solve complex problems and come up with new ideas.”

I love that last part of the previous statement.

The brain has a mental workspace that gives us “laser-like mental focus,” which paves the way for solving complex problems and coming up with unique and proprietary ideas.

I could go into many different directions on this – talking about imagination and creativity, entrepreneurship, emotional intelligence, etc. – but I want to focus on something that I know insurance and financial advisors are constantly struggling with…particularly in this new virtual age: sales.

Because in my humble opinion and experience, nothing has the ability to move prospects to action quite like igniting their imagination around powerful concepts and ideas.

And so in this guide, I want to walk you through three very specific sales scripts and techniques that you can use to tap the power of imagination – A.K.A. “the mind’s eye” – and ethically move prospects to take action.

But FIRST…

If you haven’t already checked out my other two posts on sales scripts and psychology, please take a look:

2 Psychology-Based Sales Scripts for Insurance and Financial Advisors

AND

3 Copy & Paste Sales Scripts for Virtual Insurance and Financial Advisors

Between these two guides and the one you’re reading here today, that’s a total of 8 different scripts you can SWIPE and DEPLOY.

Every good copywriter – particularly those who write a lot of direct response copy – understands how powerful the word “imagination” is.

Researchers know that simply using that word in your copy sends an instant command to the neural cortex to project the outcome of taking whatever action it is that you’re calling for.

And one of my favorite sales techniques is to use the phrase “just imagine” followed by some sort of outcome. (It could be a positive or negative outcome – it just depends on the situation.)

Here are some examples:

- Just imagine how things will be in 6 months when you’ve implemented this.

- Just imagine what your boss is going to say if you miss this opportunity.

- Just imagine pulling into the driveway and seeing the look on your wife’s face when she knows it’s going to be okay.

- Just imagine the peace of mind you’ll have when your future is secure. (Good for life insurance or long-term care.)

- Just imagine if you pass away…your spouse will be taken care of and you won’t have to worry about her future.

- Just imagine the freedom to buy what you want and do what you want because you have guaranteed income for the rest of your life.

The great thing about this technique – or any of the trio of sales scripts in this guide – is that you can use them in a variety of capacities.

You can use the “Just Imagine” Technique in blog posts, email copy, LinkedIn messages, virtual sales presentations, webinars, and any other scenario where you want to influence people to move.

As someone selling insurance or offering financial planning services, you can move people to action with greater efficiency and confidence by helping prospects picture the outcome before it happens.

In fact, I’d argue that you have to.

Because before a human decision can be made, the individual has to first see themselves doing that action in the mind’s eye.

They won’t tell you they’re doing this – or they might not even consciously know – but it’s happening. It can happen in an instant, but it must occur before a prospect can:

- Schedule a Zoom meeting

- Sign a new whole life policy

- Send over files for an IRA rollover

- Move assets from another broker to you

- Etc.

If you want someone to take a specific action, you can introduce a future BENEFIT to help move them along.

All it takes is a string of five simple words: “How would you feel if…?”

Once the subconscious brain hears those five words, it triggers a response in the mind to start imagining.

Then you move in with a specific benefit or regret.

Let’s check out a few examples:

- How would you feel if the plan you created today was the start of generational wealth for your family?

- How would you feel if you lost everything?

- How would you feel if your nest egg ran out during your retirement years and kept you from enjoying life with the grandkids?

- How would you feel if you didn’t have to worry about the market ups and downs anymore?

- How would you feel if your grandchild’s education was paid for?

- How would you feel if all of your income in retirement was tax free?

- How would you feel if this decision led to more peace of mind in your retirement?

- How would you feel if you didn’t take advantage of these historically low tax rates?

That’s it!

You can use this as an intro, close, or anywhere in between.

And like the “Just Imagine” Technique, you can use it via email or LinkedIn, on a sales call or webinar, or anywhere else you interact with prospects and clients.

I know the close – meaning the point in the conversation where some sort of decision needs to be made – is the most challenging and uncomfortable part for many insurance and financial advisors.

And that’s why I like this technique.

It helps you avoid coming across as cheesy or pushy.

Instead, it frames you as a friendly guide – a “Benevolent Alpha.”

It shows them that you’re impartial and genuinely interested in letting them make the decision.

It’s all about giving people options – three to be exact – and leading them to a logical conclusion.

Every Options Approach will need to be tailored to the specific prospect and situation, but you always start with “You have three options” and end it with a statement like “What’s going to be the easiest option for you?”

Here’s an example:

“As I see it, you have three options.

First, you could go back to sitting at your computer, Google for more quotes or sit through more meetings with advisors, hoping that someone will tell you the ‘secret magic bullet of investing,’ attend more dinner seminars, get confused and more than likely get the same kind of result with nowhere near the same amount of protection for the same investment.

Second, you could do absolutely nothing, stay exactly where you are right now, accept that your current circumstances are as good as it gets and just take it on the chin.

Or third, you could give this a try, use this policy to work alongside what you’re doing right now, let us take all the risk and see how far you go, maybe even joining the ranks of my other clients that are retiring in peace with a check coming in their mailbox every month like clockwork.

What’s going to be easier for you?”

The key to this entire method is to use three options. It doesn’t work with two or four. It has to be three.

Secondly, the options have to start with something undesirable and gradually improve until the third option is the obvious choice.

When you use a The Options Approach the individual starts to think:

“The first one is not an option…No the second one isn’t very good either…Okay, yeah…the third one is good.”

You’ll be amazed by how effective this is.

Elevate Your Virtual Meeting ‘Game’

Would you say you’ve mastered the art of virtual meetings for insurance and financial sales?

Or do you still feel like you have a lot to learn?

I’ve hosted hundreds of virtual meetings this year alone, and I know that I still have a lot to learn.

But I’ve also gone through the process of figuring out what works and what doesn’t work…firsthand.

You can access 44 of my best tips, tricks, and proven tactics for virtual meetings in my latest PLAYBOOK.

As a loyal reader of the Advisorist Blog, I’m going to give it to you for free.

Just tell me where to send it.

I Think You’re Going to Like This, Too…

If you enjoyed this guide on sales scripts and the power of imagination, I think you’re going to like the Virtual Advisor Power Hour.

It’s the fastest growing virtual gathering of insurance and financial advisors in the entire industry.

Hundreds show up LIVE every single Wednesday afternoon at 12 noon ET to soak up the insights, strategies, frameworks, and techniques that are working in our industry RIGHT NOW.

I’d love to have you join us.

All you have to do is click here and I’ll be sure to save a spot for you each week!