“When you are able to maintain your own highest standards of integrity – regardless of what others may do – you are destined for greatness.” – Napoleon Hill

The First Sip

The pandemic has changed our lives in so many different ways.

Some big and some small.

And for thousands of couples, it’s impacted wedding plans in pretty profound ways.

That was the case for Chicago residents Billy Lewis and Emily Bugg, who originally had some quite lavish wedding plans in the works.

When the pandemic first started, they assumed everything would still be fine.

Then as the weeks turned to months, they came to the decision that the only responsible choice was to call off the ceremony and hold a small gathering at City Hall.

And while they were able to cancel many of their arrangements, they had a $5,000 non-refundable catering deposit still hanging in the balance.

Rather than roll that money into some future event – which the caterer was willing to do – they decided to do something different.

They took the $5,000 and used it to spread joy in the form of a meal for 200 Windy City residents dealing with severe mental health challenges.

It was a huge success and provided a jolt of encouragement and support in a time when charitable donations have taken a big hit.

And though their big day might have ended up looking a little different than they had originally anticipated, I think their relationship with each other – and their city – is healthier than ever.

“I’m lucky to have a wife who is clever and thoughtful enough to change a not-so-good situation into something positive for a lot of people,” Lewis said.

👏 👏 👏

While it’s easy to hear stories like these and think “good for them!” I want to encourage you to think about what you can do in your own community during lockdown.

There are practical needs in every family, neighborhood, and city.

If you’ve followed us here at Advisorist for any length of time, you know that our mission is to be a Force for Good.

That’s my own personal mission with my wife AND it’s our mission here in the Advisorist family.

I’d love it if it became part of your DNA, too.

If you attended last Wednesday’s Virtual Advisor Power Hour, you heard me talk about my friend, Jerry – a mentally disabled older man – whom we’re helping provide some money to in a time of need.

You also heard from Dindo, an incredible insurance advisor who is in the process of setting up a charity to help support his brother’s family after his brother suddenly passed away this year.

I would love it if we came together in a few weeks and we had dozens of additional stories like these.

Stories of sacrificial giving.

Stories of kindness and generosity.

Stories of love and selflessness.

Not only would our communities be better for it, but I think we’d also be able to serve our clients out of a place of even greater abundance!

1 Caffeinated Neurohack

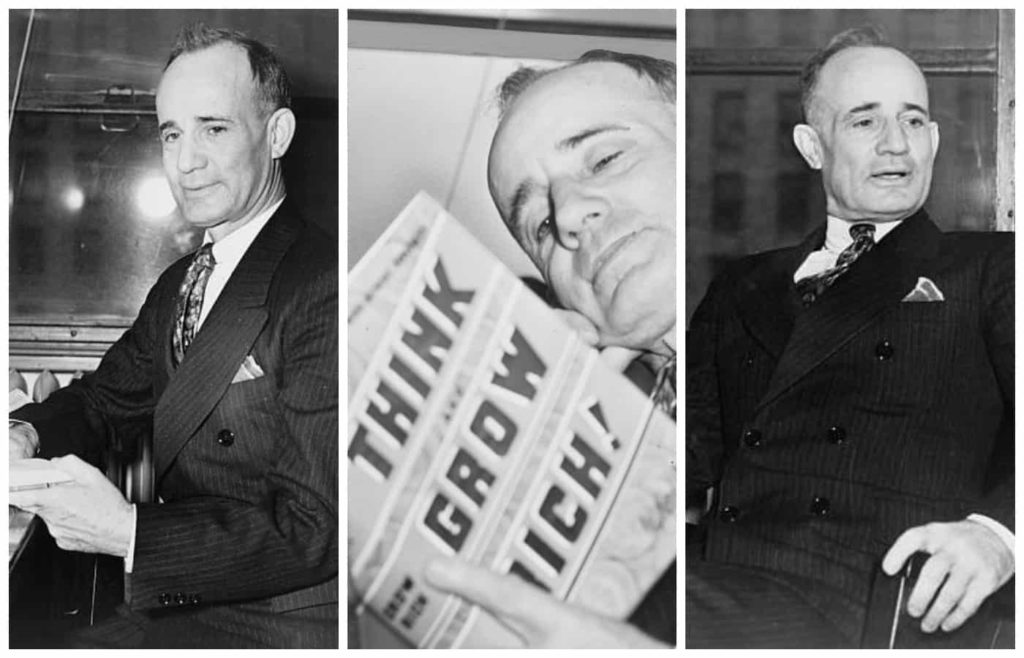

If you’ve never taken the time to read Napoleon Hill’s classic book Think and Grow Rich, I’d highly encourage you to set aside several hours this holiday season to read it from cover to cover.

As they say, it’s an oldie but goodie.

There are hundreds of takeaways and golden nuggets to extract from this classic, but one of my favorites is the “Chief Aim” concept.

In preparation for the book, Hill studied more than 16,000 people from all walks of life over a period of 14 years.

One of his biggest points of discovery was the fact that 95% of all people are considered “failures” – meaning they failed to find happiness.

He classified just 5% of people as “successes.”

What was the most noticeable difference between the failures and the success stories?

It wasn’t whether or not they were born into wealth…

It wasn’t lottery winnings…

It wasn’t even saving, investing, or entrepreneurship…

Hill found that the 95% who had failed did so because they had no “definite chief aim” in life, whereas the 5% who succeeded had definitive aims with “definite plans for the attainment of their purposes.”

This idea of having a definite chief aim has been popularized since Hill wrote Think and Grow Rich – and many have found it to be catalytic in their success.

In fact, martial arts expert and actor Bruce Lee was so impressed that he wrote his own chief aim after reading the book in 1969.

Here’s what it said:

“I, Bruce Lee, will be the first highest paid Oriental super star in the United States. In return I will give the most exciting performances and render the best of quality in the capacity of an actor. Starting 1970 I will achieve world fame and from then onward till the end of 1980 I will have in my possession $10,000,000. I will live the way I please and achieve inner harmony and happiness.”

Bruce Lee met and exceeded every one of these goals.

It’s hard to believe that’s a coincidence.

I’m not saying you can “speak” success into existence – that’s a little too woo woo for me – but I firmly believe that there’s a strong correlation between identifying your purpose in life and going out and doing it.

So I’d encourage you to take the time to write out your own definite chief aim by answering the three questions Hill asks:

- How much money do you want to acquire?

- How much time do you want to pass before you have it?

- What service or plan do you have to acquire it?

Once you come up with your statement, take 30 seconds to repeat it every morning.

You might be surprised by how it changes your mindset.

Marketing Psychology Quick Hit

We’ve spent the past couple of weeks here at Advisorist really focusing on the psychology behind sales.

From Power Hours to blog posts, it’s something we’ve zeroed in on.

And I absolutely LOVE it.

Sales and psychology are two of my favorite topics – and it’s awesome when they converge.

So, keeping in the spirit of research-based sales psychology hacks, I want to give you a list of 9 highly persuasive words that every insurance and financial advisor should have in their vocabulary.

Whether you’re sending out emails, connecting on LinkedIn, or conducting a sales presentation via Zoom, these words/terms are guaranteed to make you more persuasive:

- Avoid

- Free

- I don’t know

- Imagine

- Now

- Save

- Unusual

- We

- You

Now here’s my challenge to you:

How many of these words can you use in your next sales call?

Find clever combinations. Try leading off with these words. Try closing with them. Mix them in with the other scripts we’re teaching.

Just find a way to put them into action!

Do This First Thing Monday AM

How often do you communicate with your clients?

Whether over the phone, on social media, via email, or on a Zoom call?

(Hint: It’s probably not as much as they’d like.)

I know many advisors who are so leery of overstepping and “spamming” their clients that they don’t communicate with them at all.

If you’re in that boat, I want you to step back and look at it objectively.

Have you ever had a client say to you, “Sheesh! I wish you’d communicate with me a little less. I’d prefer to know LESS about what you’re doing with my money.”

No! That would be crazy.

Whether they’ll say it out loud or not, they’re much more likely to think, “I really wish my advisor would be a little more open and forthcoming so that I’d know everything is okay.”

The question is, how do you do that at scale?

There are a multitude of ways, actually, but I’m going to give you one simple challenge that you can do tomorrow morning.

I want you to write a blog post.

It could be a short blog post, or it could be several thousand words.

You could post it to your website, or you could publish it on LinkedIn. (I’d actually recommend the latter.)

You could make it a general market update, or you could tell a personal anecdote.

The what and how are less important than actually doing.

Write a post.

Publish the post.

Share the post.

And see what happens.

Your clients will enjoy getting to hear from you, and you never know what kind of conversations it’ll spark.

What’s New With Advisorist

[✍ ] 2 Psychology-Based Sales Scripts for Virtual Insurance and Financial Advisors [Part 1]

[✍ ] 3 Copy & Paste Sales Scripts for Virtual Insurance and Financial Advisors [Part 2]

Happy Sunday,

Jeremiah