Knowledge gained early in life is more likely to be remembered.

This principle can apply to many things. Parents can also use this universal truth to teach their children about money and investments, but knowing where to begin can be challenging.

Is it a good idea to start with how a bank account works or why financial institutions pay interest on deposits?

Is it more sensible to explain why people purchase stocks by talking about how buying shares in a company is similar to owning part of a business?

What about insurance and mutual funds? Should the explanation include stock indices and how they are calculated?

It can all seem very complicated. There’s another problem, as well. A dry and theoretical discussion could bore the listener.

Teenagers are likely to stop paying attention and start playing with their phones the moment they realize where the conversation is going. So, what should parents do?

It may be advisable to take a slightly different approach.

Instead of jumping straight into the meaning of complicated financial terms, try talking about the principles of investing. What are the basic rules about money that every person should know?

Here are eight rules that are of paramount importance.

- The Power of Compounding

Albert Einstein reportedly called the power of compounding the eighth wonder of the world. An excellent way to explain compounding is to talk about how doubling a number repeatedly can make it grow to an unimaginably large sum.

The rice and chessboard story is sure to create an impression on anyone who hears it. It goes something like this.

There was an ancient king who loved chess. He was also fond of buying new chessboards. A craftsman thought he would take advantage of this by making a high-quality chessboard and selling it to the king. He would fool the king into paying him an astronomical price for his work.

When he saw the chessboard, the king was impressed. He asked the craftsman its price and was surprised to learn that all he wanted was “a little rice.” How much rice exactly?

The craftsman said he wanted one grain for the first square on the chessboard, two for the second, four for the third, eight for the fourth, and so on for all 64 squares.

That seemed quite reasonable, so the king agreed. But when he saw the calculation for the total amount of rice that was required, he realized he had been fooled.

The king needed to give 18,446,744,073,709,551,615 grains of rice to the craftsman. That’s about 210 billion tons of rice.

Money can grow similarly. Here’s a simple calculation that shows the power of compounding. We’ll assume that a sum of $1,000 is invested at an annual return of 10%.

At the end of Year 1, $1,000 becomes $1,100 ($1,000 + 10% of $1,000 = $1,000 + $100 = $1,100.)

At the end of Year 2, the sum will increase to $1,210 ($1,100 + 10% of $1,100 = $1,100 + $110 = $1,210.)

And so on.

At the end of Year 25, the total amount will be $10,834.

At the end of Year 50, it will increase to $117,390.

What if the initial amount is $1,000, and $100 is added every month for the next 50 years (we’re assuming the same annual interest rate of 10%.) The cumulative amount will rise to an astronomical $1.58 million.

- The Power of Diversification

When you put all of your assets into one investment – such as a single stock, mutual fund, or piece of real estate – you have the chance for high risk and high reward also in places like totovip.info.

If the stock, for example, goes up 25 percent, you could see your portfolio surge by 25 percent. But if it gets cut in half, so does your nest egg.

Banking on the former happening and ignoring the possibility of the latter is not smart.

And this is why any financial advisor worth his salt will encourage you to embrace a concept known as diversification.

Diversification is the idea that, by carefully blending assets with a variety of characteristics, you can develop a portfolio that’s able to withstand a variety of market conditions. It’s essentially a way to hedge against sharp fluctuations.

This is something many young investors learn early on. Just ask Lesley G. – a client of Larry Saffer, who owns the Saffer Financial Group Inc.

“Recognizing our goal to build sufficient and secure funds for the years when we would be dependent upon our savings to supplement social security payments, Larry advocated diversification of our financial assets between IRAs, investments, and annuities,” Lesley explains. “At all times Larry was mindful of minimizing financial risk while ensuring an adequate return on our investments.”

- An Advisor Should be an Advocate

Speaking of Larry Saffer advocating for diversification, it’s important that young advisors understand what to look for in a financial advisor.

You’re not hiring the smoothest talking salesperson or the individual who offers you courtside tickets to the biggest game in town. You go with the advisor who will go to bat for you when nobody else will.

This reminds me of Phil Lyons in Miami. Phil is known to advocate on behalf of his clients. He once lobbied Florida’s State Legislators and got a rate reversal for windstorm premiums in the Florida Keys.

He did so by analyzing the data, discovering that it was flawed, and then confronting the Legislators. It was eventually discovered that the head of the Senate was pressuring them to put the rate hike there, instead of on his constituents where it rightly belonged. Phil has fought and always will fight for his clients!

When you’re old enough to get an advisor, look for someone like Larry or Phil who will advocate on your behalf. That’s the key to protecting your investments and growing your portfolio over many decades.

- The Risk-Return Paradigm

The risk-return paradigm is also referred to as the risk-return tradeoff. This investment principle states that the higher the risk, the greater the potential reward.

Although it’s not very apparent, the risk-return paradigm is closely related to the first principle we discussed: The power of compounding.

We saw that the power of compounding could work to provide investors with surprisingly high returns, provided it’s allowed to work its magic over a sufficiently long period.

Two factors play a role in determining how much money there is at the end of the investment period. They are the length of time for which the sum has been invested and the rate of interest.

Let’s see how this works:

- An investment of $1,000 that earns interest at a rate of 2% per year becomes $2,691 in 50 years. Why 2%? That’s the rate an investor can expect to earn on a high-yielding deposit with a bank.

- What if we increase the interest rate from 2% per year to 10%? That’s the average annual return of the S&P 500 for the period from 1926 to 2018.

- Remember that a 2% annual return resulted in a sum of $2,691 at the end of 50 years. Increase the rate to 10%, and the final figure is $117,390.

What happened? How did the figure of $2,691 shoot up to $117,390? The higher rate of interest has made all the difference.

Now, here’s the crux of the issue.

There’s a higher degree of risk involved in earning a return of 10%. What does that mean?

In a worst-case scenario, an investor could lose all the money that has been invested in a financial product that promises a high return.

A deposit with the bank carries a low degree of risk. Thus, a deposit that earns 2% per year is practically risk-free. It’s a low-risk, low-return investment. The Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per depositor at each bank.

However, stock investments carry no such guarantee. A stake in a company that goes bankrupt could become worthless, but well-managed companies can provide high returns.

An investment in the Apple IPO in 1980 would have provided a total return of over 51,000% over the last 39 years. This calculation excludes the dividends the company has paid.

- Delayed Gratification

In the 1970s, psychologist Walter Mischel conducted a groundbreaking study that came to be known as the “marshmallow test.” This test involved placing a marshmallow or some other desirable treat in front of a four-year-old.

The child was then given an option. Eat the sweet treat immediately or wait for a few minutes. If a child chose the latter, she would be given a second sweet treat.

Children who had a higher degree of self-control didn’t eat the first marshmallow. They had the willpower to delay the gratification they would get from eating the sweet treat.

Researchers learned that the kids who did well on the test also did better in school.

But the follow-up work on the marshmallow test was even more exciting. The children who had the willpower to stay from the first marshmallow also went on to get higher SAT scores.

Additionally, they had fewer behavioral problems later in life and were not as likely to be overweight as adults.

So what does investing have to do with it?

A person who can delay gratification is more likely to be able to accumulate wealth.

If an individual spends her entire salary every month or buys things on credit, she probably won’t have money left over to invest.

- Avoid Credit Card Debt

It’s essential to have a basic knowledge of how credit cards work. When a payment of, say, $100 is made with a credit card, the seller receives a slightly smaller sum.

It could be approximately $98. The difference is the amount that the credit card issuer and other intermediaries make.

At the end of the month, the cardholder receives her credit card statement. If the entire amount is paid before the due date, the cardholder’s liability is restricted to the original purchase price of $100.

But what if the holder utilizes the credit facility the card issuer offers and pays a smaller sum? The credit card company would charge interest on the balance that is “rolled over.”

Now things get interesting. The cardholder would pay interest that averages about 17% per year to the credit card company.

Additionally, any new purchase that is made with the credit card would accrue interest from the date of purchase. Thus, every time the card is used, it would lead to extra interest accumulating.

Millions of people roll over their credit card balances at the end of every month. On a cumulative basis, Americans have about $413 billion outstanding against their credit cards.

This includes both the amounts that have been rolled over and the current month’s transactions.

The lesson here is to avoid credit card debt. It’s essential to pay off the statement balance at the end of every billing cycle.

Not doing this could mean needlessly paying large amounts of interest to the card company.

- Wants vs. Needs

“Wants” constitute things like food, shelter, clothing, and utilities. “Needs” are different. They form part of discretionary spending: the extras like eating out, going to the movies, or entertainment.

Individuals who can’t distinguish between wants and needs are unlikely to save much. An excellent way to explain the wants vs. needs concept is through the 50-30-20 rule popularized by Senator Elizabeth Warren.

The 50-30-20 rule is simple, easy to remember, and can work wonders for those who follow it diligently. How does it work?

According to the rule, individuals should divide up their income like this:

- Allocate 50% towards needs. This would include rent, groceries, and other essential expenses.

- An additional 30% can be used for discretionary expenditure. This money would go towards “wants”: things that provide enjoyment but aren’t necessary.

- Finally, the remaining 20% should be saved. These funds can be set aside for long-term goals and for collecting money for an emergency fund.

Of course, it isn’t necessary to follow the exact percentages laid down by the 50-30-20 rule.

For example, an individual who is paying interest to the credit card company must try to pay off that debt first. Savings can be deferred until later.

On the other hand, a yearly bonus need not be divided up in the 50-30-20 ratio. A higher percentage could be saved.

- Managing Investment Costs

Most investments involve incurring certain costs. An individual who buys shares in a company would have to pay his broker a commission.

Mutual fund investments require the payment of management fees. The various charges and expenses that accompany an investment can have a significant impact on returns.

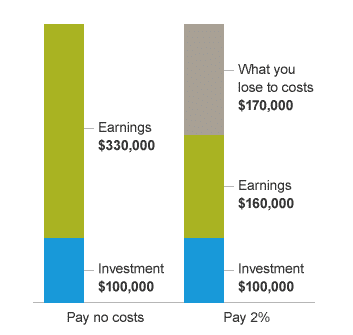

Consider a mutual fund that carries an annual fee of 2%.

This may not seem like much. An investor could think the returns that the mutual fund makes would more than make up for this cost. However, there couldn’t be anything further from the truth.

Fees and expenses can have an unexpectedly significant effect on returns. This example from Vanguard, an investment company with about $5.6 trillion in assets under management, is revealing.

Say an investment of $100,000 earns a constant rate of return of 6% per year for 25 years. At the end of this period, the initial amount would have risen to $430,000.

Now, let’s build in a 2% yearly cost. Fees and expenses at the rate of 2% of the cumulative balance would be deducted at the end of every year.

What impact would this have? Instead of $430,000 at the end of the 25 years, the total would fall to — wait for it — $260,000. A sum of $170,000 would have been lost to costs.

Costs can eat away at your investments.

What’s the lesson here? Don’t assume that costs have an insignificant effect on investment returns.

They can be the deciding factor between a profitable investment and one that doesn’t provide adequate returns.

The Bottom Line

What’s the best way to teach these principles to youngsters? Remember that young people don’t necessarily do what their parents tell them to do.

Instead, they emulate their parents. Thus, the best way to teach them the basics of investing is to set an example.

If they see their parents following these principles, they’re likely to adhere to them too.

Want More Powerful Insights?

Join me every Wednesday afternoon at 12 noon ET for a free 1-Hour WORKSHOP where we teach the lessons, frameworks, and techniques responsible for generating 61,429,096 leads and $312,493,381 in revenue ALL in insurance and financial services over 15 years.

Click HERE to add the Virtual Advisor Power Hour to your calendar.