If you want to send a room full of financial advisors and investment bankers into full-on “eye roll mode,” just mention the word Bitcoin.

It’s a controversial (and somewhat confusing) word that our industry has evaded for many years.

But it’s becoming harder and harder to ignore.

Like it or not, Bitcoin is here to stay.

Its full potential remains to be seen, but it’s not going to disappear this year, next year, or even this decade.

And if you’re confused about what it is, what role it plays, and how to handle Bitcoin as an advisor with high-net-worth clients…you’re in the right place.

I recently interviewed one of the foremost Bitcoin thought leaders in our industry – an advisor just like you – and he gave me a lot to think about.

If you’re willing to be open in how you view this hot button topic, I’m convinced you’ll walk away with more knowledge you can use to serve your clients well over the coming months.

But, wait! Bitcoin is…

The skeptics have plenty of fuel to keep their fire going.

They say things like:

- Can you not see that it’s a massive bubble waiting to pop?

- There are only several million users…it’s a drop in the bucket!

- There are so many competitors…who says it’ll end up being the market leader?

- People use it for crime.

- It has very limited uses.

It’s 2005 and these “skeptics” represent the bulk of financial advisors and investment professionals talking about a little $40 stock known as Amazon.

Amazon’s price has crashed nearly 40 percent.

There’s incredible competition in the ecommerce space.

The customer base is miniscule in comparison with the larger marketplace.

Sellers are increasingly using it as a way to evade sales tax and preserve profits.

Is it an online book store? Or something else?

There are more questions than answers.

And yet here we stand in 2021 and the stock is currently worth well north of $3,000 a share.

If your clients’ portfolios didn’t have any Amazon back in 2005, you would have been in good company. But if their portfolios don’t have any investments in Amazon today…well…you should probably be fired.

Financial advisor Andy Edstrom believes we’ll eventually look back at Bitcoin in 2021 like we do with Amazon in 2005.

In his words, “There will be two kinds of investment portfolios: Those of people who were wise enough to own some Bitcoin and those who weren’t.”

And when it comes to advisors, Edstrom has some strong words.

He believes there will only be one type of advisor in the future, and “those who didn’t buy Bitcoin for their clients will be like those wealth managers who never bought Amazon: out of business.”

Those might be harsh words…and it’s certainly possible that he’s off the mark…but as I said earlier, it’s getting harder and harder to ignore cryptocurrency – and Bitcoin in particular.

Be Careful Who You Listen To

I want to be clear about one thing: I am not telling you to put your clients’ assets into Bitcoin.

What I am encouraging you to do is to get educated.

The average investor is getting hit over the head with Bitcoin this and Bitcoin that every day.

It’s on the news…

It’s all over social media…

It’s the basis for office small talk…

It’s a popular topic of conversation on the golf course…

Bitcoin is being discussed on a regular basis.

And if it hasn’t happened already, you’re going to have clients come to you and ask for your opinion.

What will you say?

Will you have an educated response?

It won’t be this year, or even next year, but I believe there will come a time when advisors who are uneducated on cryptocurrency will lose clients to the advisors who are knowledgeable.

I also believe it’s important who you listen to.

There are a lot of voices talking about Bitcoin online, but only a few are worth listening to as you pursue your crypto education.

My friend Jeff Nabers is one of them.

Meet Jeff Nabers…the Guy Who Beat Wall Street and is Back for More

Rewind to the early-2000s and Jeff is working in the mortgage banking industry in Myrtle Beach, South Carolina.

The money is FLOWING and life is EASY.

It’s the peak of the “refi boom” and Jeff is responsible for producing TENS of millions of dollars in mortgage loans.

He’s learning so much and creating so many connections that he ends up starting his own mortgage business.

With so much cash hitting his bank account, he decides he needs to do something with it. So he buys real estate.

Lots and lots of real estate.

In total, Jeff and a business partner gobbled up over 100 properties in the first two years of investing.

Their goal was to use the rental income to sustain a life of leisure and a care-free retirement.

Then 2006 hit…and you know what’s coming next.

Or do you?

While the real estate market was still scalding hot, my buddy Jeff saw something that very few others did: A BUBBLE.

He got serious about studying the real estate market (and economy), and every indicator he saw was telling him that things were about to POP.

So he didn’t delay.

He sold his mortgage business.

He sold all investment properties.

He shorted the market.

His colleagues were ruthless – calling him “insane” and “out of touch.”

But then it happened.

Wall Street collapsed…foreclosures skyrocketed…and the economy sank.

His friends and colleagues never saw it coming….but Jeff sure did.

After things normalized a bit and the economy began its long recovery, Jeff started looking for somewhere to stash his piles of cash and precious metals (the only two investments he had at this point).

In 2013, he went into Bitcoin.

And for the last few years, he’s been screaming it from the rooftops to anyone who will listen…

“Bitcoin isn’t going away.”

Jeff has a track record for being right about these things…so I’d listen up!

Why Bitcoin?

Over the past few years, Jeff has dedicated thousands of hours to studying economy and learning everything there is to know about cryptocurrency and Bitcoin for financial advisors.

His education has taught him that there’s a flaw with the U.S. Dollar – and it’s leaking a lot of value.

If you study the dollar, you’ll find that it’s a radical experiment that’s likely to fail sooner rather than later. Throughout history, there’s a 100% failure rate with the fiat money system.

It fails every time…yet the U.S. (which started its fiat system in 1971) has decided to give it another go.

While Jeff isn’t one to predict a doomsday deadline, he’s wary that there could be a day when the USD is no more.

And while he was admittedly a bit skittish when he first came across Bitcoin, he eventually realized that it wasn’t going away. (That was in 2013…and in 2021 he’s as confident as ever before.)

How Do We Know Bitcoin Isn’t a Bubble Ready to Pop?

What follows are my notes from my interview with Jeff Nabers.

Continue reading for his thoughts on why Bitcoin isn’t going anywhere but UP. (And why you owe it to your clients to learn more.)

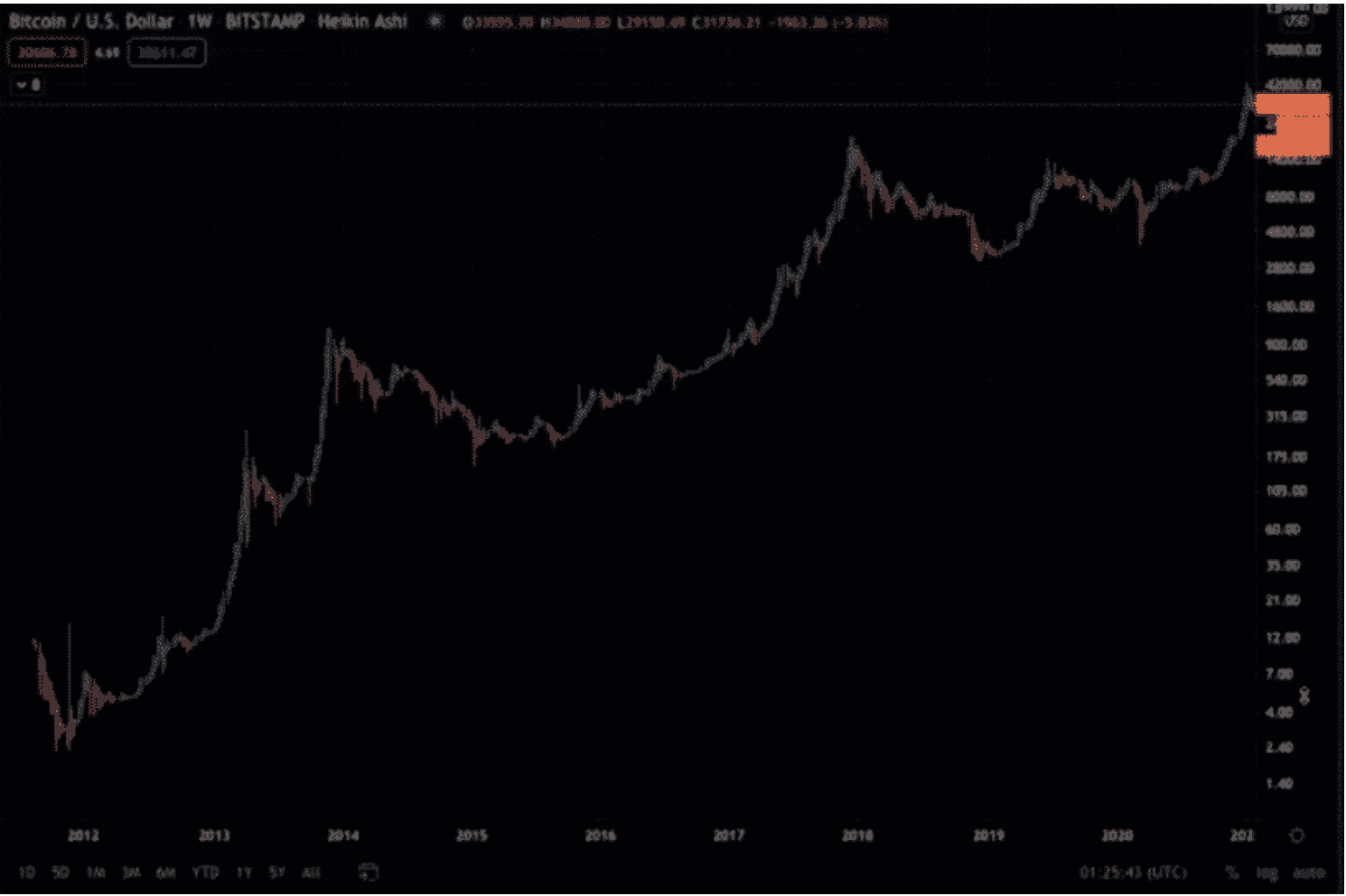

In Jeff’s opinion, the best way to understand the rise of Bitcoin and what’s happening is to study the charts.

TradingView.com has an excellent platform for analyzing. (Tip: Pull the data from Bitstamp, which has the most historical data.)

Looks like a bubble, right?

Well, this is actually a problem with the charting view. Bitcoin is doing something so amazing that you can’t use a standard linear chart to get a picture of what it’s doing. The plots are incorrect.

You have to put it into the log chart.

How different does this look?

It has volatility, but it’s steadily climbing up and to the right.

If you want to make sense of price movements:

- Zoom all the way out and look at the whole chart.

- Plot using a logarithmic chart

Bitcoin is volatile in the short-term, but much more steady and predictable in the long-term.

The only way that anyone has figured out how to lose money with Bitcoin (in the last decade) is by holding it without a multiyear outlook and/or not securely storing it.

Anyone who handles the security and has a long-term horizon is in the green right now.

Any pullbacks – like the one at the end of January 2021 – are part of the fluctuations. If any asset was as small as Bitcoin, we would have as much (if not more) volatility.

This is a tiny asset class compared to the stock market, real estate, etc. Any time someone puts millions of dollars in or out, it moves the asset a massive amount.

Is the Crypto Industry Becoming More Sophisticated From an Investment Perspective?

We’ve been through technological innovation before (in history). We get used to how things have been very recently.

Go back to the 1990s and remember what life was like. This blog would be unreadable, you couldn’t grab an Uber, you couldn’t even watch a video online. Just using email was a challenge.

When the internet came around, it was a mess. It was basically associated with scams. The internet had not yet matured. It needed iteration, failure, and growth.

When it comes to Bitcoin, you could say we’re in the “second wave,” where people are not trying to build cryptocurrency – they’re trying to build crypto assets.

However, almost none of them are competing with Bitcoin.

Bitcoin is in the category of “digital hard money.” This means nobody can print more of it. (Unlike the dollar, which is being printed at a rate nobody has ever seen.)

Bitcoin has won the crypto space. It’s “the” digital hard money.

Think back to the tech bubble in 1999. There was Amazon.com and Pets.com. At the time, you almost couldn’t tell the difference. (Similar market caps.)

It’s clear which company won.

Similarly with cryptocurrency markets, there are lots of “straight-up scams.”

You have to educate yourself. Your clients are trying to educate themselves. And if they look things up in the middle of the night, they might fall for one of those scams.

Jeff is the first to say it: “95% of crypto is garbage. But you don’t want to flush out the baby with the bath water. Because Bitcoin is the main baby.”

What is the underlying value of bitcoin?

For any asset that doesn’t produce cash flow, the value is always determined by supply and demand.

All major currencies in the world are fiat currencies – constantly expanding. This means all money in the world right now is expanding.

This is a problem.

We’re in a currency war where every central bank in the world needs to print money to keep up. It’s a race to the bottom.

The inflation rate of Bitcoin is currently right around 2%. The USD, for perspective, has been around 35% in the past year.

Bitcoin is a little ticket to the game of hyperinflation. If hyperinflation does happen, you’re going to be on the receiving end of a tens of trillions of dollars wealth transfer that’s global in nature.

As Jeff says, “When you invest in Bitcoin, you’re getting a slice of a big pie that nobody can shrink.”

Should everybody own Bitcoin?

Everyone should at least look into Bitcoin, Jeff believes.

There’s a certain amount of education you want to do about it, otherwise you’ll have “weak hands.” If you educate yourself and put together a strategy, then yes you should buy Bitcoin.

The fact that you’re reading this right now puts you at an advantage.

You’re in the top 1% of people who are continuing to learn on an ongoing basis.

It’s not too late and you should understand that Bitcoin was literally designed to go to $1M in value.

Every Bitcoin is actually 100 million fractional shares (transactable units). The whole setup is designed for the smallest transaction to be worth a single penny.

Do you have to buy an entire Bitcoin?

You can buy smaller fractions of Bitcoin than any other asset.

You can buy as small as 1/100,000,000.

You can put $5 or $100 if you want.

This makes it the most accessible asset in the world, because it’s globally traded and there are almost no minimums.

Every 4 years, the inflation rate is cut in half. And when it gets cut in half, it marks the beginning of a 4-year cycle in the Bitcoin economy.

In that 4-year cycle, it usually takes 6-12 months after that “supply shock” for the next bull market to start. This lasts for a couple of years.

We’re currently less than one year into this (as of early 2021). If this matches up to past cycles, we still have a lot of growth. ( Possibly $150k-$250k by the end of this year.)

In Jeff’s words, “Something spectacular is going on. The longer we put it off to understand it, the more opportunity we lose.”

The Power of Bitcoin for Financial Advisors

The real power of Bitcoin for financial advisors is to understand what happens with Bitcoin when you add it to a portfolio.

While Bitcoin under a microscope appears to be highly volatile and scary, it’s exciting to see how it fits into a holistic portfolio.

In almost every multi-year period, Bitcoin actually brings the volatility of the overall portfolio down.

“It’s a truly uncorrelated asset,” Jeff says

No matter what the Federal Reserve does, Bitcoin operates independently. It can’t be turned off. (It’s like the internet. You can’t take it down.)

There aren’t many (if any) assets you can add to your portfolio that are totally independent of what the Fed does. This makes Bitcoin an excellent mode of diversification in a portfolio.

The Sortino Ratio is a great place to look to understand why Bitcoin makes sense in a client’s portfolio.

As you may know the Sortino Ratio looks at upward volatility as profit (we like that) and downward volatility as loss (we don’t like that).

We’re looking at downside volatility as risk and upside volatility as return. We’re asking, how much risk do I have to take for every percentage rate of return?

Over multi-year periods, there’s less risk with Bitcoin. (The returns outweigh the dips.)

Just a little Bitcoin exposure in a portfolio can give you less risk, increase upside, and diversify assets.

As is the case with any other investment you put into a client’s portfolio, it’s all about diversification, growth potential, and downside protection. Bitcoin, by all objective measures, does all three.

How Do You Buy and Store Bitcoin?

This is one of the most common questions I hear.

Once you get to the point where you’re personally interested in buying some Bitcoin, what do you do?

While there are any number of options, Jeff has a few favorite platforms and storage options.

If you’re interested in grabbing a free guide, we’ll be happy to send it to you via email.

[optin-monster-shortcode id=”msqwonqxrqlgtsgk1dac”]

Want More Incredible Interviews With the Brightest Minds in the Industry?

This blog post was based on an incredible LIVE interview that I did with Jeff Nabers on the Virtual Advisor Power Hour.

For more access to our industry’s brightest minds and most well-respected thought leaders, join us live every Wednesday at 12pm EST / 9am PST.

Each week, we unpack 7-figure strategies that are working in today’s virtual landscape to help insurance and financial advisors bring in more AUM and commissions.