“Continuous learning is the minimum requirement for success in any field.”

– Brian Tracey

Best Thing I Read All Week

“Yo, Ellie! What are you doing for the next 3 months?”

“Are you thinking what I’m thinking?” Ellie asked her bestie Sandy.

And that was all it took for the 80-year-old BFFs to embark on a whirlwind 80-day globe-trotting escapade.

Departing from Dallas, Texas, the adventure began in the frozen tundra of Antarctica.

The feisty ladies then ping-ponged across the planet like a pair of octogenarian Indiana Joneses:

🧑🎄 Chasing auroras in the North Pole (watch out Santa!)

🐪 Channeling Lawrence of Arabia on camelback in Africa’s deserts

🛷Cruising on a husky-pulled sleigh in Finland

🎈Living it up in an Egyptian hot air balloon

🚗 Cruising through Bali’s streets like silver-haired Thelma and Louises

🏰 Soaking up the architecture in Rome (and potentially sampling some vino)

“This trip has really made us even closer than we were,” Ellie says. “Both being widows, we just kind of found each other. We both had phenomenal marriages, the best husbands in the world. And then we found the best friends in the world.”

And in case you’re wondering…2024’s adventure is already in the works. Watch out, world!

The 1 Alternative Approach Most Successful Advisors Are Taking…

The formula for success as a financial advisor is simple. (Though…it’s not always easy.)

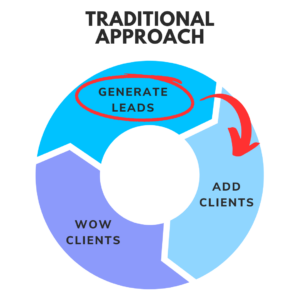

You generate leads, turn those leads into clients, make those clients happy….rinse & repeat.

It’s a self-feeding growth cycle.

But here’s the thing about this cycle…

While we’re conditioned to focus most of our energy on the lead generation phase, there’s power in starting with wowing clients.

When you overemphasize wowing clients, you don’t have to focus as much energy on generating leads – they start coming to you.

This is something financial advisor Christine Timms spent her 33-year career doing.

Her theory was that leading with customer experience makes the challenge of generating leads a moot point.

So she decided to build a team that would make this possible.

At the start, she was sharing an assistant with 3 other advisors.

By the time she retired, she had her own team of 6 ½ assistants.

“I believe my practice would have plateaued at about 20% of its final revenue and AUM if I had not grown my team beyond one assistant,” she says. “Most, maybe all, successful advisors I have met over the years were growing their teams.”

According to Timms, there are 7 primary client benefits associated with having a support team:

- Increased accessibility

- Faster responses (think: Usain Bolt meets email)

- More communication

- More services (like the Swiss Army Knife of finance)

- Multiple relationships

- Continuous service

- Better advice

And when you add all of these together, you get happier clients who are more likely to leave positive feedback, talk about you, and refer you to others.

So while I’m all for investing in lead generation strategies, don’t forget about the real ace up your sleeve…

…a team that blows people away with A+ client satisfaction.

Recession…or Figment of Our Imaginations? 🧠

Chalk this one up as interesting…

In a recent study funded by The Wall Street Journal, 80% of Americans say they don’t feel so great about the nation’s economy (with 85% anticipating things will get even worse).

But I want you to check out some other findings from the study:

- 62% are satisfied with their present financial condition

- 62% say their personal financial situation is either getting better or staying the same

- 66% say their financial situation is better and/or where they expected to be at this stage in life

- 72% say the rising cost of living is of no concern, not a problem, or minor in nature

Doesn’t seem very consistent, does it?

How can 80% of Americans think the economy is bad and will get worse, while over 60% are satisfied with their financial situation?

Advisor Rick Kahler suggests it might come down to media exposure and biased reporting. >> Read more here

It also speaks to how heavily influenced people can be.

As advisors, we’re in a unique position to speak facts and cut through the fear-inducing noise that most media companies push.

A recession may very well be on the way…but all hope is not lost.

|

Check Out These Related Guides 👉 Survey Says: How Top FAs Communicate With Clients |

Weekly Market Roundup

▶️Nowhere to hide. Analysts raise eyebrows as gold, oil, bonds, bitcoin, and S&P 500 stocks huddle up like an awkward prom dance. They say the market is overbought, which is cuing doomsayers whispers of a “black swan event” with nowhere to hide.

▶️Economic slip ‘n slide. Economists – the industry’s version of fortune tellers – believe falling inflation is happening faster due to tighter credit in the wake of last month’s bank failures. Still, a Bloomberg survey shows experts are betting 65% odds on a recession crashing the party within a year.

▶️Tesla bargain bin. Tesla clings to sanity amid a downpour of bad news. Cue the fifth price slash this year, operating margins nosediving from 19% to 11.4%, and TSLA limping in at $164 on Friday. One analyst forecasts a jaw-dropping $28 price tag. Garage sale, anyone?

▶️Nickels for dimes. Increasing raw metal prices have driven the minting cost of a nickel to 10 cents. A pair of senators are reaching across the aisle to propose a bill giving the U.S. Mint a green light to tinker with the metal content in an effort to save taxpayers some change.

Weekly ChatGPT Prompt 🤖

ChatGPT can be a handy tool to help create content to grow your practice. So here’s a prompt you can try to up your writing game.

Prompt: Write a [adjective] [platform] post about [topic].

Example: Write a witty LinkedIn post about saving for retirement.

Try It Here!

Jeremiah D. Desmarais

CEO, Advisorist

#1 in ROI-Driven Training for Advisors