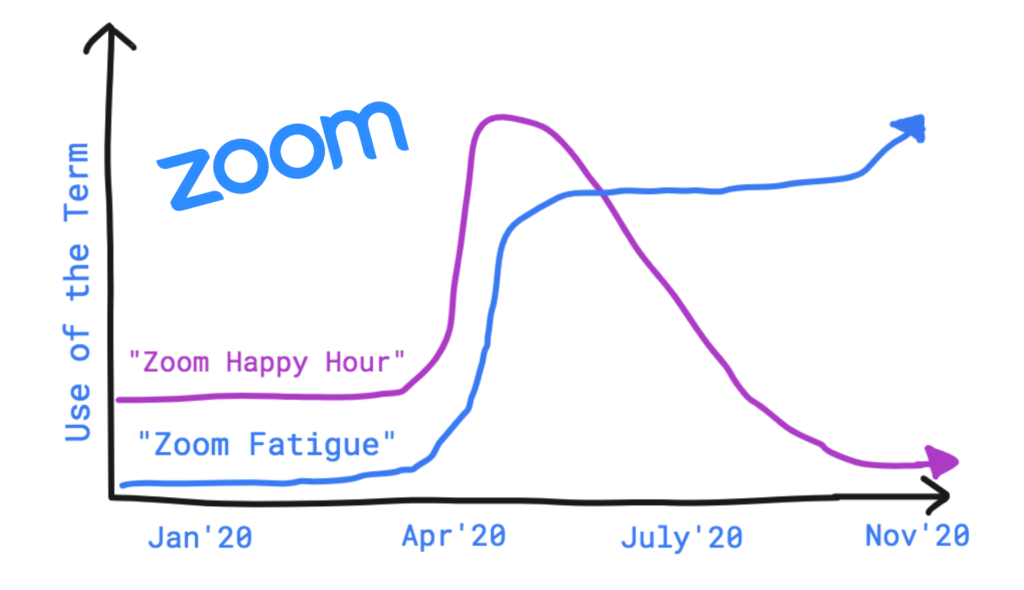

When the initial COVID-19 lockdowns occurred in North America around the end of March/ beginning of April, Zoom went from a virtually unknown tool to one of the most searched terms on the internet.

But within a few weeks, people quickly tired of Zoom meetings.

And instead of looking for fun ways to leverage the platform – like “Zoom Happy Hours” – boredom and frustration quickly set in.

As an insurance or financial advisor who relies on Zoom to prospect and sell, this creates problems.

The last thing you want is for people to be bored with one of the few platforms that actually works in 2020.

But my team and I have discovered a powerful antidote to this problem and I’m itching to share it with you.

The Problem of Zoom Fatigue

Prior to 2020, approximately two-thirds of all social interactions were face-to-face.

But as is the case with most things, the pandemic has sent the pendulum swinging in the opposite direction.

Virtual is the new normal (and has been for months). Even today – as restrictions have relaxed in most parts of the country – the majority of social interactions are now screen-to-screen.

And it’s getting to us all…

This includes your clients and prospects.So much so that we have a new phrase in our vocabulary: “Zoom fatigue.”

While Zoom had its moment in the spring, people have quickly grown tired of back-to-back-back video conferencing meetings.

Zoom quickly went from 10 million daily meeting participants in December 2019 to a whopping 300 million in April 2020 and the fatigue is real.

Compared to face-to-face, texting, phone calls, and social media, professor Jeffrey Hall (author of Relating Through Technology), says energy use during a Zoom call is significantly higher.

“Zoom is exhausting and lonely because you have to be so much more attentive and so much more aware of what’s going on than you do on phone calls,” Hall says.

Other contributing factors include watching yourself speak (which most people find disconcerting), tech issues, and all of the blips and delays that seem to dominate Zoom exchanges.

While I’ve gone to great lengths to show insurance and financial advisors how to overcome some of the classic tech issues, glitches, and communication problems that so often plague people with Zoom…it’s hard to ignore the fact that Zoom fatigue is a major turnoff.

This isn’t something you can just ignore or attempt to power through.

Zoom fatigue will likely get worse before it gets better and it’s up to you to work around it so that you can continue to reach the right prospects with the right message.

How to Fight Back Against Zoom Fatigue

If you’re still asking clients and prospects to schedule a virtual “meeting” with you, I’ll take a not-so-wild guess and say your “no-show” rate is pretty high.

Why?

Because nobody wants to attend a “meeting” – especially in light of Zoom fatigue.

Calendars are already filled up with meetings – many back-to-back – and the last thing somebody wants to do is schedule another hour-long Zoom call with an advisor who they assume wants to sell them another product or service.

Some will ignore the request for a meeting. Many will say no. And then you’ll always have that particularly frustrating group of people who schedule a meeting and then fail to show up.

But cancelling Zoom calls and going back to face-to-face meetings and other forms of selling isn’t the answer.

Yes, face-to-face meetings will eventually return. But they’ll never again be the norm.

Virtual meetings are the way of the future. You just have to be careful about how you frame them.

That’s right, the solution to combating no-shows is as simple as re-framing Zoom meetings and using more descriptive vernacular to get people to show up.

If you think that sounds too basic, I’d challenge you to avoid jumping to a forgone conclusion.

Here at Advisorist, we’ve experienced firsthand just how effective it can be.

With one simple tweak in how we name our meetings, we’ve scaled our show up rate from 55% to 93%.

And that’s not the warm market with carefully cultured leads.

I’m talking about the ICE COLD market.

If you know anything about show up ratios and meeting analytics, you know that 93% is basically unheard of.

And I’m about to let the cat out of the bag.

I’m going to show you how you quickly and effortlessly reframe meetings to achieve show up rates as high as 93% in the cold market. Keep reading to find out more…

Naming Virtual Meetings for Higher Show Up Rates

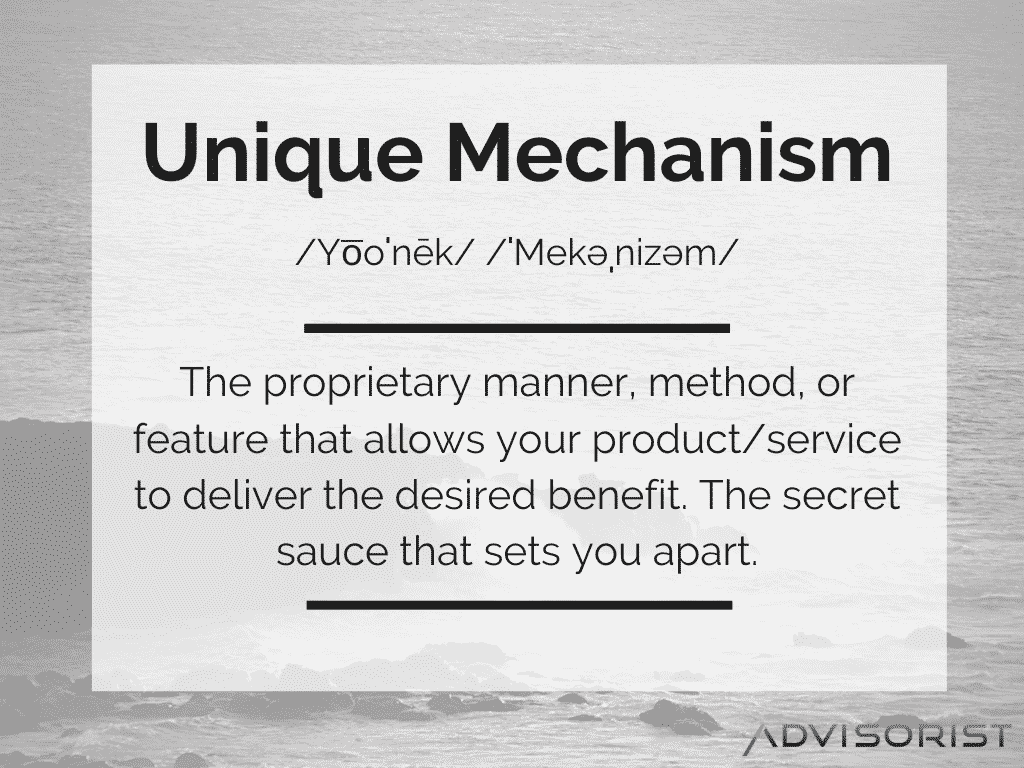

The secret ingredient to reframing virtual meetings is to stop calling them meetings and to use a “Unique Mechanism” instead.

While this might be the first time you’ve encountered the term, you’re familiar with Unique Mechanisms in your own life as a consumer.

Pick any major company in a crowded market and you should be able to quickly identify the Unique Mechanisms they use in their advertising and branding.

Gillette is one of my favorite examples.

Their Gillette Fusion ProGlide Power isn’t that much different than any of the other comparable razors on the market. Yet they consistently outperform the marketplace.

One of the reasons they do so – aside from their MASSIVE ad spend – is that they go to painstaking lengths to reframe basic features so that they sound special.

The Gillette Fusion ProGlide Power actually has seven different Unique Mechanisms in a single product:

- Enlarged lubrastrip

- Micro-comb

- Redesigned precision trimmer

- Battery power

- Thinner, finer blade edges

- Low-resistance coating

- Central blade stabilizer

Gillette’s razor really isn’t all that different from other products in the space, they’ve simply zeroed in on their top features and made them sound more compelling.

The more crowded a market becomes, the more sophisticated your Unique Mechanism needs to be. (And the more mechanisms you need to have.)

But here’s the good news: As crowded as our industry is, there really aren’t that many Unique Mechanisms in the insurance and financial services space.

The industry is our oyster…we just have to be intentional about how we seize it.

My challenge to you is to develop Unique Mechanisms for every meeting you have with prospects and clients. In doing so, you’ll discover:

- It’s easier to get people to show up.

- You instantly gain more authority and credibility.

- It helps you structure meetings in such a way that people show up and stay engaged.

How do you develop a Unique Mechanism for a meeting?

It’s not nearly as difficult as you might think.

There are ultimately three elements to consider:

- Positioning

- Perception

- Expectation

Think of each of these as a bucket. And in order to name a meeting, you need to grab a word or term from each bucket. The combination is a proprietary blend of words that becomes your Unique Mechanism.

Here are some examples that would work in our industry:

1) Positioning: You can’t just call something a “breakthrough session.” There has to be something relevant to your industry or niche.

- Retirement Revolution

- Rocking Retirees

- Money Mavericks

- Retirement

- Tax Protection

- Peaceful Retirement

- Financial

- Ideal Retirement

2) Perception: Words that are evocative that you can use to help people understand what the meeting will be about:

- Breakthrough

- Discovery

- Strategy

- Revitalization

- Fitness

- Victory Lap

- Sleep Well

- Possibility

3) Expectation: Stop using the word “meeting” and come up with something that sets the proper expectation for the value they will receive.

- Session

- Strategy Session

- Audit

- Discovery

- Clarity Call

- System

- Chat

- Power Hour

- Coffee Chat

- Breakthrough Session

And here are some examples based on the descriptive and evocative words I came up with in the three buckets listed above:

- Retirement Revolution Strategy Session

- Retirement Fitness Strategy Session

- Tax Protection Discovery Session

- Money Mavericks Clarity Call

- Ideal Retirement Discovery Call

- Money Revitalization Breakthrough Session

- Financial Victory Lap Chat

- Rocking Retirees Coffee Chat

- Peaceful Retirement Power Hour

Instead of putting “15-minute meeting” on your Calendly, you’re actually going to put these Unique Mechanism names on there.

Put this in your email signature line, LinkedIn summary section, social profiles, business card, website header, etc.

We’ve done this in our own business and, as mentioned, show rates have dramatically improved from 55% to 93%.

It’s made a massive difference in our ability to reach prospects and I’m confident that it’ll

revolutionize your own approach in the age of Zoom fatigue.

Okay…Now What?

Giving your meeting a Unique Mechanism and convincing a prospect or client to add it to their calendar is a HUGE step in the right direction, but it’s not the only key to success as a virtual advisor.

Now you have to go out and EXECUTE.

But don’t worry…I’m not going to leave you hanging.

My team and I have developed The Definitive Virtual Meeting Playbook for Insurance & Financial Advisors to show you how to host meetings that CONVERT.

It’s filled with 44 virtual meeting tips, techniques, and conversion tactics that you can implement right away.

And it’s my gift to you for the low, low price of….FREE.

All you have to do is plug in your email below and that will tell me that you’re interested in converting more prospects into beefier commissions and higher AUM…

…and I’ll shoot it over to your inbox.

Stock Your Virtual Advisory War Chest

The time for going virtual is NOW.

But you can’t be lazy or indifferent in how you do it.

If you want to generate bigger and better results, you have to be intentional about your approach.

And it’s my goal to help insurance and financial advisors like yourself make the SHIFT away from the traditional brick and mortar style of advising to a virtual formula that allows you to enjoy greater flexibility, superior scalability, and beefier revenues.

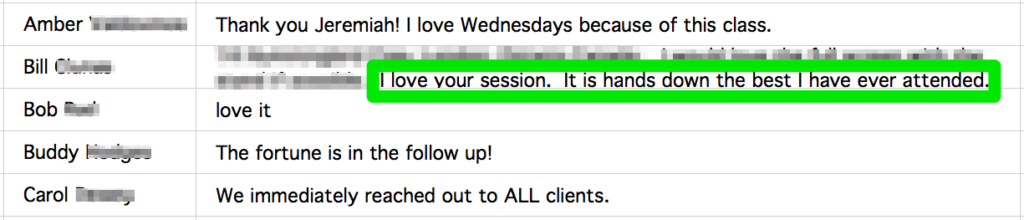

These Virtual Advisor Power Hours are totally FREE.

They’re our way of giving back to our tribe in a time of great need.

But I’ll tell you one thing for certain…

They’re worth far more than the admission price.

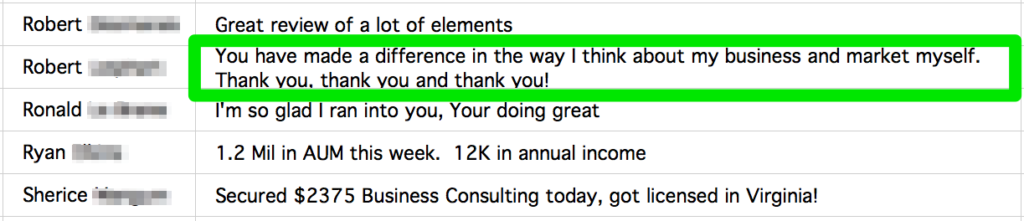

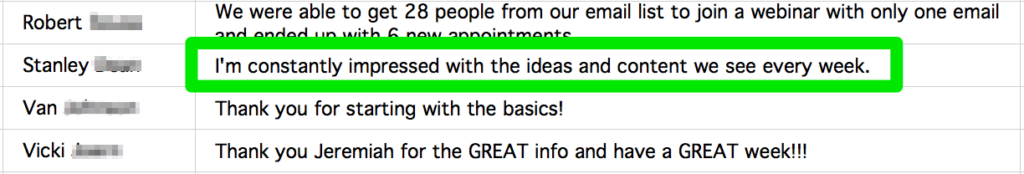

Here’s what some of the thousands of advisors who’ve signed up for our Power Hours have to say:

The only “catch” is that you have to show up LIVE.

Unless you’re an Advisorist Max member, there are no replays or second chance viewings.

I’m showing up and playing full out. All I ask is that you bring that same energy and mindset.

CLICK HERE to add the Virtual Advisor Power Hour to your calendar.